Guest blog by Peter Teresi, Certificial

Guest blogs are written by contributors outside of HawkSoft. The author's views are entirely their own and may not reflect the views of HawkSoft.

Over the last decade, all industries have been moving toward becoming more digital, whether it be through utilizing data over paper or more advanced transformation such as having virtual robots handle customer service. Within the world of insurance, businesses want to buy, submit claims, and access their coverage information anytime and anywhere. That need for real-time information exchange is becoming the norm, and often expected. Dynamic insurance verification presents a tremendous opportunity to automate the painful manual process for Certificates of Insurance (COI). And that opportunity starts with you and your agency management system.

This article at a glance:

- Why is real-time insurance verification necessary?

- How dynamic insurance verification works

- Management system integration

- Benefits of dynamic insurance verification

- Benefits to the certificate holder

- Benefits to the agent or broker

- Tracking more than effective dates and coverage limits

- New service possibilities for agents

- Get started with Certificial

Why is real-time insurance verification necessary?

The Certificate of Insurance as a means of insurance verification is very much point-in-time. Certificate holders may receive an updated COI once a year, however quite a bit could change between renewals. Large certificate holder organizations employ teams of resources to manage the insurance compliance of their suppliers (your policyholders), an operational expense far too high for such a low level of confidence that the information provided remains accurate.

Certificate holders are looking for ways to ensure they have the most recent coverage information on their suppliers and are beginning to request COIs on a much more frequent basis. This creates a larger burden on them, the policyholders, and their agents to continuously provide updated COIs.

How dynamic insurance verification works

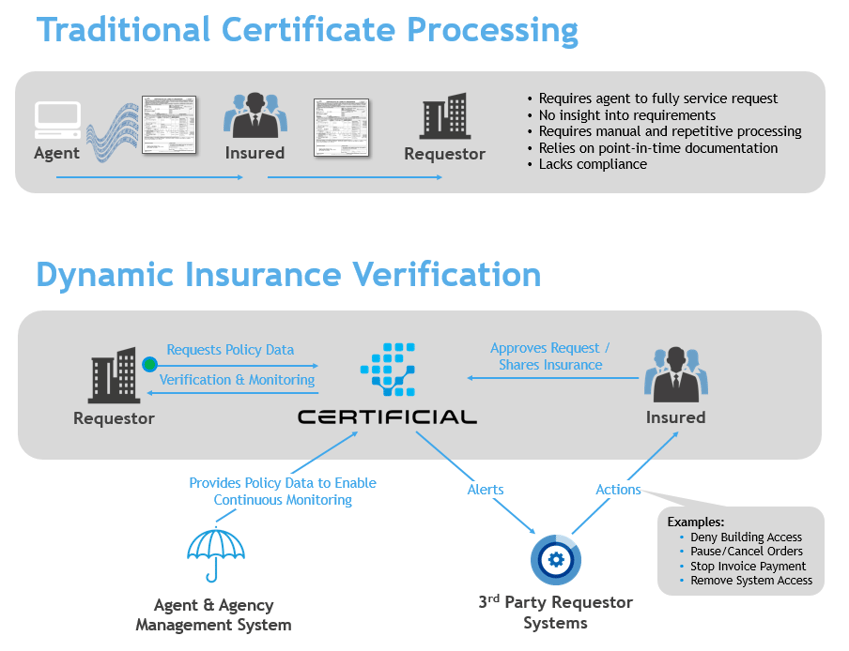

Dynamic insurance verification platforms, such as Certificial, make the COI process real-time rather than point-in-time by using APIs to integrate directly with both the insurance provider and the companies requesting proof of insurance. Rather than coverage being verified only once a year, all parties are constantly updated about the status of their suppliers' coverage. Any updates, renewals, etc. are automatically pushed to each certificate holder.

Whereas previously the COI was used as a vehicle for the input of information into an agency management system or other database, the dynamic verification process allows the COI data to be used to output real-time insurance verification information to all parties.

Whereas previously the COI was used as a vehicle for the input of information, the digital verification process allows the COI data to be used to output real-time insurance verification information to all parties.

Gone are the days of “folding parties” to get paper-based COIs mailed to each certificate holder at renewal time. Digitalization has made this possible in just a few clicks.

Management system integration

For the dynamic verification process to be successful, it must interface with all three stakeholders: the agent, the policyholder, and the certificate holder. Dynamic insurance verification platforms must integrate with the agency management system in addition to the insurance provider and the certificate holder to ensure all parties have the most recent information. This information can be continuously monitored and tracked to ensure any changes to coverage are visible to all parties.

Digital insurance verification platforms must integrate with the agency management system in addition to the insurance provider and the certificate holder to ensure all parties have the most recent information.

HawkSoft’s agency management system is committed to making the COI process more automated and accessible for all parties involved. It offers a Certificate Wizard that makes the COI creation more efficient for agents, and a Self-service Certificates portal that allows insureds to access the COI and generate them for new certificate holders. Combined with integration with Certificial’s dynamic verification technology, this offers a complete solution for COI management.

Integrating dynamic insurance verification with your management system provides the benefits of having requests for insurance made digitally and coverage information available dynamically.

Benefits of dynamic insurance verification

Benefits to the certificate holder:

Reduce Risk

Know suppliers’ current coverage at all times via dynamic feeds from the management system by utilizing continuous monitoring and tracking.

Get Alerts

Receive notifications when a supplier’s insurance coverage lapses, is canceled, or is reduced below their required limits.

Reduce Complexity

Manage all suppliers in a single location.

Save Time

Utilize reusable templates to quickly request insurance coverage.

Eliminate Uninsured Activity

Use the dynamic data to trigger action for non-compliance by denying system access or building access, stopping payment, or cancelling an order.

Benefits to the agent or broker:

Client’s Compliance

Ensure your client maintains compliance with their customer throughout the time they are engaged in business.

Less Rework

Instantly know whether your clients meet the certificate holder’s coverage requirements, as the data is compared directly to their request.

Save Time

Push policy changes and renewals to all of your certificate holders with just a few clicks.

Save Money

Reduce operational costs and keep more of your commissions.

Push Data as Well as Request

Push dynamic insurance verification to certificate holders as certificate data issuance in addition to responding to requests for insurance. The benefits of policy changes and renewals can still be utilized.

Manage Cert Holders

Get visibility into who clients are currently sharing their policy information with at all times and easily maintain active relationships.

Tracking More Than Effective Dates and Coverage Limit

By establishing a connection between policyholders and certificate holders, dynamic verification systems can track the history of the entire relationship, including any changes to policy information, all Certificates of Insurance, renewals, endorsements, allowed exceptions, etc. The ability to capture all historical transactions provides a full log for auditing and reporting.

Digital verification systems can track the history of the entire relationship, including any changes to policy information, all Certificates of Insurance, renewals, endorsements, allowed exceptions, etc.

New Service Possibilities for Agents

In addition to creating new possibilities for certificate holders, there is a trend emerging amongst agents who are adopting dynamic verification. They are beginning to manage the vendor insurance compliance on behalf of their clients by helping monitor their suppliers’ coverage information. This type of value-added service has allowed agents and brokers to engrain themselves into their clients’ normal business operations in a way they haven’t been able to in the past.

Get started with Certificial

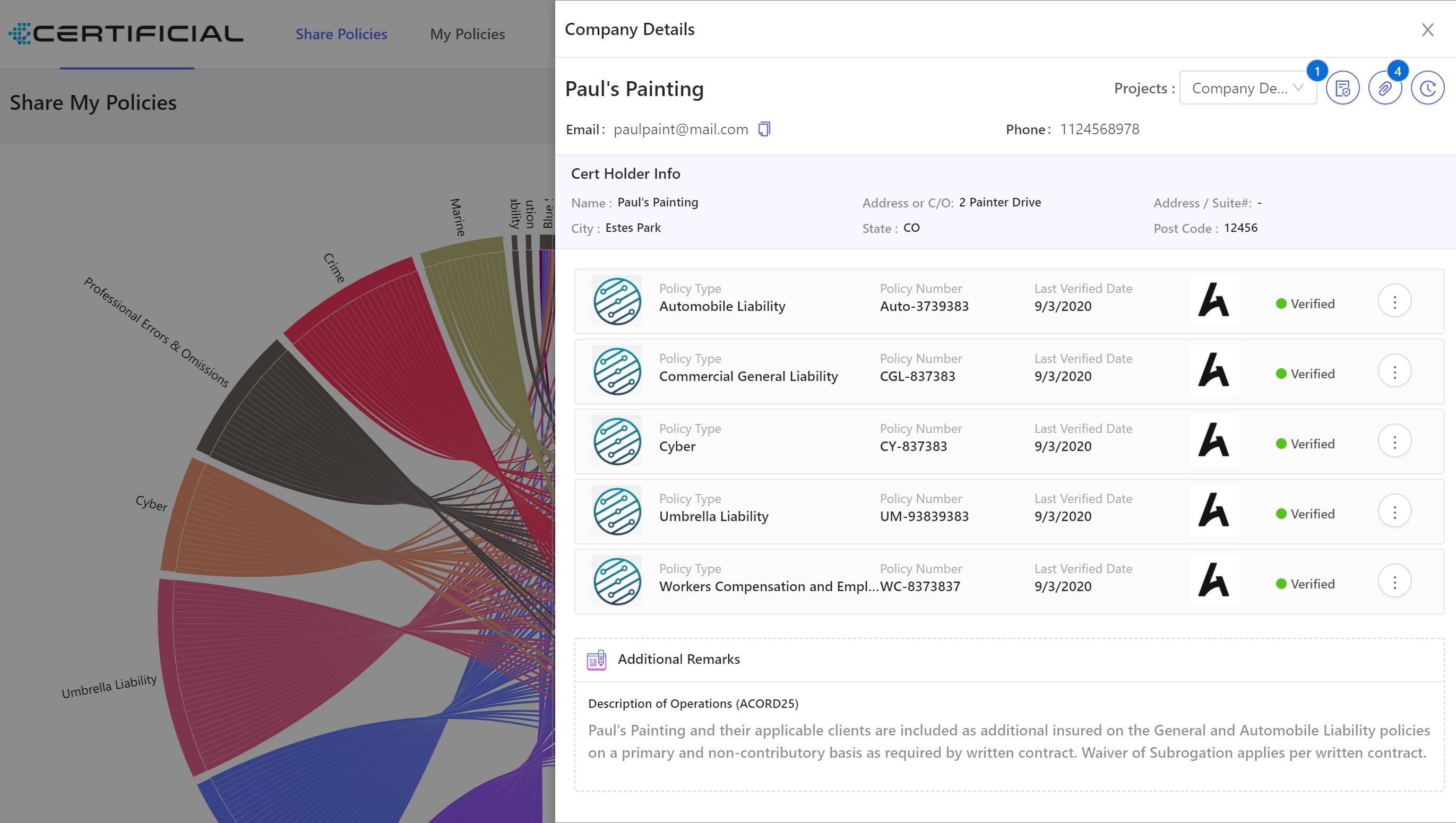

Dynamic insurance verification and continuous monitoring of coverage data is the future. Certificate holders are beginning to require their suppliers to have their information made available to them, and ensure it’s been recently updated. The good news for agents and brokers is that Certificial’s integration with Hawksoft makes it possible to manage COI data in a single location.

Screenshot of the Certificial system

Charles Anzalone of First State Agency, a HawkSoft user, is one of the early adopters of dynamic insurance verification. Charles’ primary reason for utilizing this new approach is because as a broker, he and his agents no longer need to be on standby to issue a COI.

“Taking the reactive nature out of the proof of insurance process and allowing for continuous updates will greatly reduce the number of fire drills our agency deals with. We’re thrilled with how dynamic insurance verification can save us time and allow us to focus more time and energy on sales and service to our customers.”

- Charles Anzalone, First State Agency

Best of all, Certificial’s business model charges the companies who use it to verify insurance for their suppliers, allowing the platform to be free of cost for agencies, brokers, and suppliers. There’s no reason not to begin using dynamic insurance verification today and transform the burdensome process of COI management into real-time data accessible to your clients and cert holders.

Ensure your clients’ compliance for free with CertificialAdd Certificial integration through the HawkSoft Marketplace |