Graphic by Rocket Referrals

Guest blog by by Torey & Carl Maerz, Rocket Referrals

Guest blogs are written by contributors outside of HawkSoft. The author's views are entirely their own and may not reflect the views of HawkSoft.

This article at a glance:

Boost client retention with NPS

Identifying your Net Promoter Score (NPS) can be extremely valuable for your agency (if you need a refresher on the basics of NPS, take a look at Rocket Referrals’ guide to NPS or HawkSoft’s instructions on how to set up an NPS survey and calculate your score). But once you’ve gotten the results, how do you turn the data into more business for your agency? In this post we’ll explain how you can take action on your NPS results to increase your overall client retention by an average of 5% over two years.

Five percent might not seem like much, but Bain & Company—the business consulting firm that invented the NPS—studied the impact of client retention on a business’s overall profitability and found that a 5% increase in customer retention produces more than a 25% increase in profit. Why? Promoters tend to buy more over time and refer others, while the operating costs to serve them decline. They will often pay a premium to stay, rather than switching to a competitor with whom they’re neither familiar nor comfortable.

Bain & Company found that a 5% increase in customer retention produces more than a 25% increase in profit.

Retention may not feel as exciting as sales, but if your goal is growing your agency, the impact retention has on your bottom line is impossible to ignore. Simply put, if you focus on client retention you will make more money. Your NPS results can give you key insights on how to make better retention a reality.

Turn your clients into promoters

Bain & Company writes about how detractors (those scoring 6 or below) defect at higher rates than promoters (scoring 9 or 10) and have shorter and less profitable relationships with the company. At Rocket Referrals we found this to be the case across insurance agencies by tracking the retention rates of groups of clients over two years, broken down by how they responded to the NPS survey. We learned that an insurance agent’s promoters are on average 2.5 times more likely to be retained over two years than are their detractors.

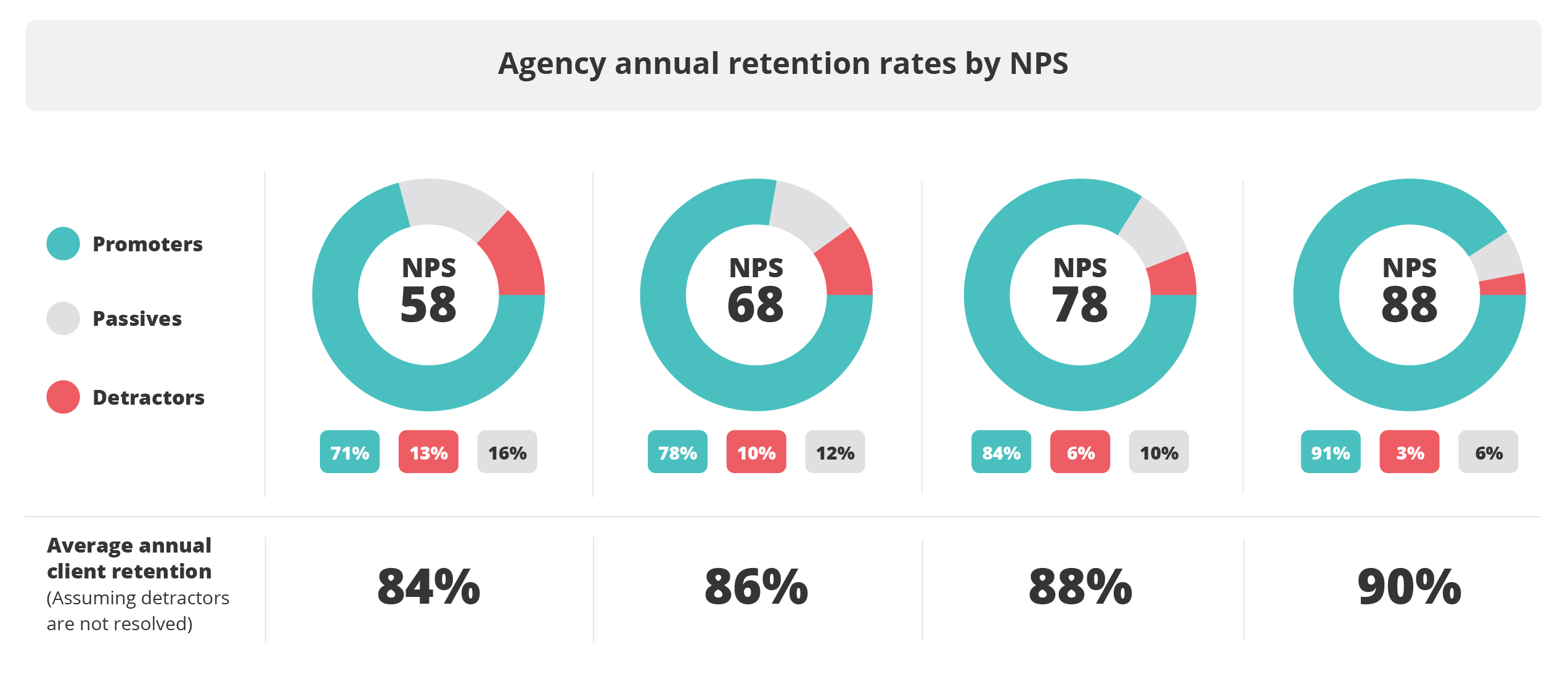

We created the graph below to demonstrate how an agency’s breakdown of promoters, passives, and detractors directly impacts their NPS and client retention. With every 10-point rise in NPS, an agency sees an average 2% increase in overall client retention. Note that this data assumes agencies are not contacting their detractors—which also significantly increases client retention.

With every 10-point rise in NPS, agencies see an average 2% increase in overall client retention

Data & graphic by Rocket Referrals

An agency increases their NPS by turning their unhappy and lukewarm clients into happy and loyal clients—in NPS lingo, by converting detractors and passives into promoters. We also looked at data from over 5 million NPS responses from clients of insurance agencies to learn how they can increase their NPS. Here are the four most important things we found:

1. Send NPS surveys regularly

An agency’s NPS is not static. This is because clients often change how they feel about their agency. Thus, to maintain an accurate picture of client loyalty, an agency needs to continue sending NPS surveys over the long term. Bain and Company talks about why businesses should be consistently surveying customers in this article. We recommend agents send an NPS survey to each of their clients every six months, to both personal and commercial lines, and to spread the surveys out over time so there is always new data coming in. We’ve found that some agencies we work with are careful about how much communication they send their clients, and therefore express concern that two NPS surveys per year may upset their clients. This is a relevant concern, but after sending NPS surveys for thousands of insurance agents across the country, we’ve only heard of a few instances when clients actually complained about receiving too many surveys from their agent. In general, we feel the benefits of receiving consistent feedback from clients far outweigh the risk of a couple people complaining.

2. Engage detractors

The NPS survey can have a very high response rate if sent properly—much higher than old-fashioned satisfaction surveys. This allows agents to identify upset clients (detractors) that are thinking about shopping around. By finding them early, the agency still has time to retain them. We measured the impact of agents engaging with detractors versus not reaching out to them after they respond to the NPS survey. We found that by calling a detractor and addressing their issue within 48 hours of uncovering them, an agency more than doubles the chances of retaining them over the next two years.

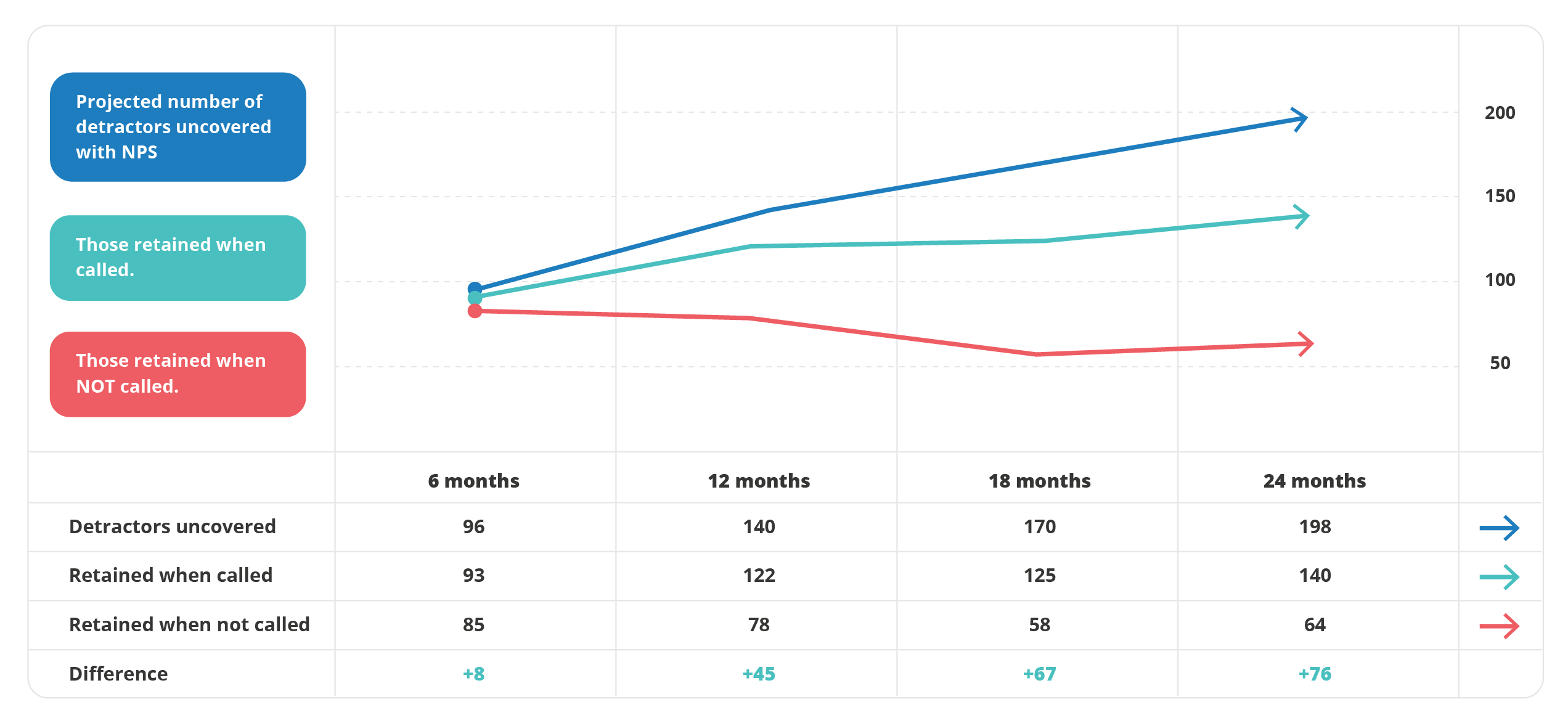

The effect of calling detractors on client retention

Agencies retain 2.5% more clients over 24 months by calling detractors

Data & graphic by Rocket Referrals

This chart illustrates how an agency can benefit from identifying and calling detractors over a two-year period. In this example, an agency with 3,000 clients will retain an average of 76 more clients over 24 months—a 2.5% increase in overall client retention—by simply calling their detractors instead of leaving their problems unresolved. Another important (and often overlooked) way NPS surveys increase client retention is by collecting client testimonials. In this Rough Notes article we talk about how testimonials collected from NPS surveys help insurance agencies retain and attract new clients.

By calling a detractor and addressing their issue within 48 hours of uncovering them, an agency more than doubles the chances of retaining them over the next two years.

3. Act on feedback

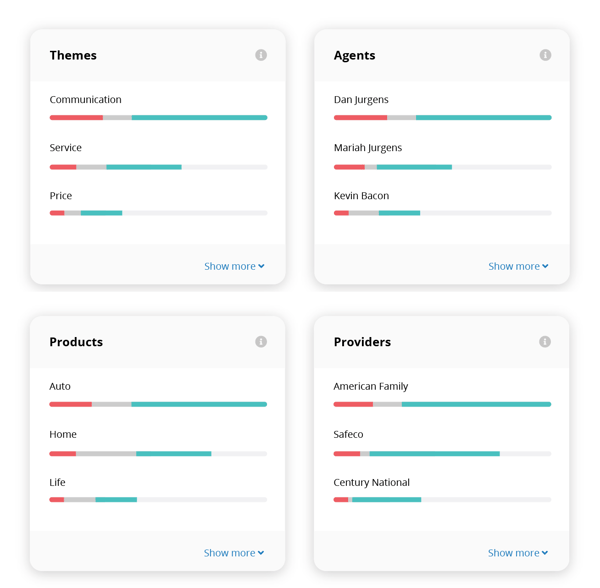

When clients respond to NPS surveys they often provide written responses explaining their score. You can use this data to implement changes at your agency that will improve the client experience and boost your NPS in the future. If quantifying the written responses seems overwhelming, try breaking positive and negative feedback into actionable categories. Here are some categories we recommend for sorting and acting on NPS feedback.

Graphic by Rocket Referrals

Themes

When a client provides feedback on the NPS survey it can almost always be grouped into an overarching theme: e.g. service, price, communication, etc. These themes represent areas of concern or delight for a client—so the agency knows where to focus efforts to improve, or what to keep doing. Across all agencies, we’ve found that communication-themed feedback (whether positive, neutral, or negative) accounts for nearly 3 out of 4 NPS responses. For this reason, improving communication is next on our list.

Agents

What do your clients think about your agents or CSRs? NPS feedback might help you find out who your clients like most, and why. It will also uncover hidden issues. For example, find out how often Linda, your new CSR, is mentioned among client feedback. Are promoters or detractors talking about her? If detractors are constantly grumbling about Linda, then it’s probably time she gets her act together or hits the bricks. On the other hand, if promoters are regularly praising Linda, then maybe she’s due for a promotion.

Products

The effort an agent makes to reach out to a client usually depends on what types of policies the client has with the agency. This can lead to specific product lines having more loyal clients than others. For example, everyone knows that clients with multiple policies have higher retention than those with just one. Feedback from NPS surveys will tell you exactly why this is, so you can work on improving loyalty across all clients and policy types.

Providers

Every insurance carrier that underwrites your policies also plays a role in the experience a client has, whether through billing, claims or other support. Do your clients keep having issues with a specific insurer? Which carrier has the most loyal clients? Knowing this is helpful when deciding which carriers to focus on in the future.

4. Improve communication

Our data shows that three out of four times when an insurance agency receives feedback from an NPS survey, it mentions how well (or poorly) the agency communicates with their clients. When the feedback is negative, 1/3 of the time it’s related to how the agency failed to return an email or phone call, or inability to easily contact them. This can be fixed by creating processes to follow up with client requests, and by increasing the ways clients can contact you—for example, enabling webchat or adding texting capabilities to your website. Or maybe you need an assistant!

75% of the time an agency receives feedback from an NPS survey, it mentions client communication.

The other 2/3 of negative feedback around communication—and by far the largest issue clients have with their insurance agency—is related to proactive communication. In other words, clients are most unhappy with the frequency and quality of communication they receive from their agent throughout the year. A client feels like a number when the agency only pays attention to them when obliged, or when it otherwise benefits the agency—such as when it comes time for renewal, claims, or cross-selling. Here are a few things you can focus on in your communication strategy to prevent clients from feeling this way.

Loyalty communication

Clients that are promoters today may change how they feel about the agency if the relationship becomes one-sided. Especially when asking clients for testimonials and online reviews, it’s important for agencies to show their clients they appreciate them in return. Agents can do this by sending communication directly to their promoters, like a handwritten card or personal and thoughtful email or text. The message should do nothing more than thank them for being a client—don’t spoil it by sneaking in a sales offer. As a general rule of thumb, the more automated the message feels to the client, the less impactful it will be. The client wants to feel like you are taking the time to thank them personally. As a bonus, promoters are much more likely to refer their insurance agency if they’ve recently had a positive experience with them. Delighting promoters with a personal thank you can also inspire them to refer you.

Individualized emails

Clients need to feel like their agent is always looking out for them and advising them on insurance. Email is a great way to send clients valuable information and news that is relevant to them. Rather than sending a newsletter to all your clients, which risks being ignored because it isn’t personally relevant to them, consider sending emails to clients individually with content that is meaningful to them based on their policies, demographics, etc. A client is much more likely to read something that you’ve picked out for them individually, and thus find value in it.

Personal relationship

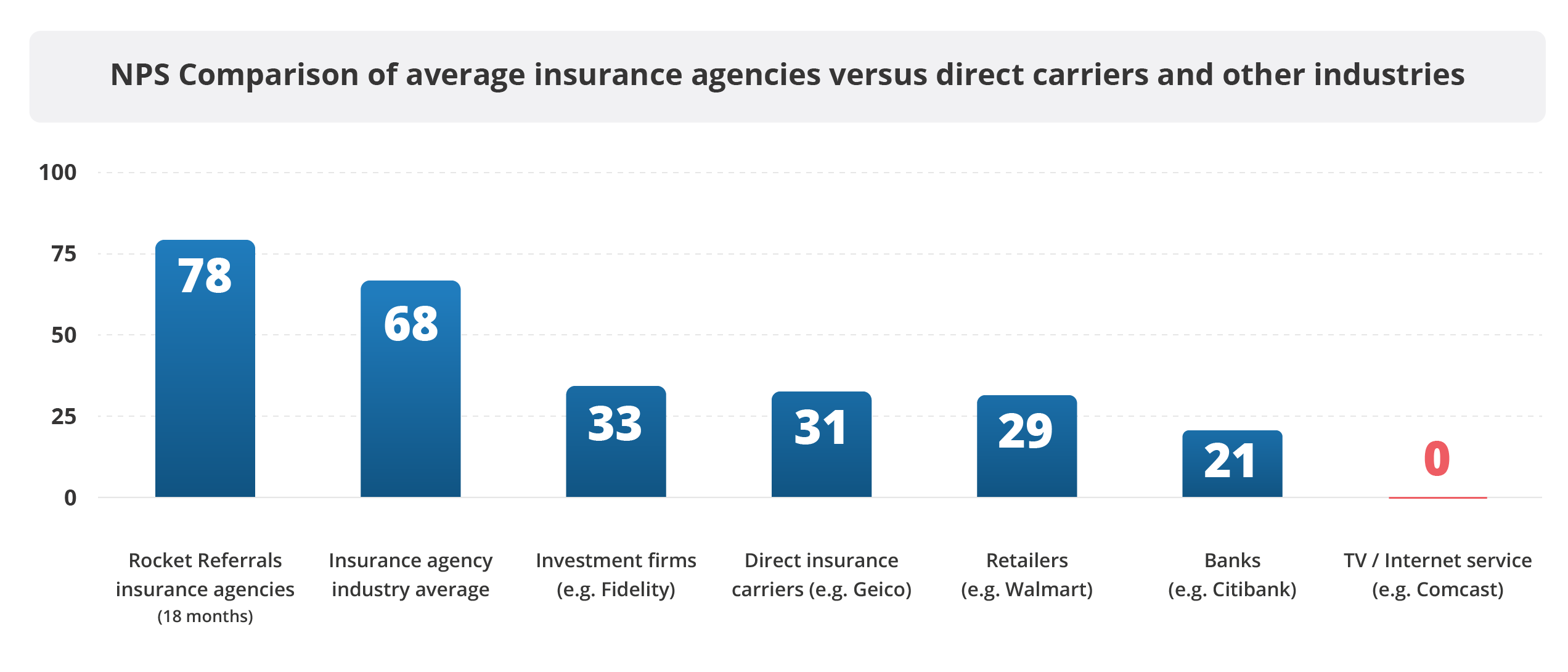

Insurance agencies inherently have a higher NPS than most businesses because of the relationship the client has with their agent. They feel like they know their agent personally. Although many agents think their clients stick with them foremost because of their excellent service, this may not necessarily be the case. Direct carriers can also provide great service with huge investments in technology and AI. But carriers don’t know their clients personally. Although service plays a big role, research shows that it’s the personal relationship that matters most.

General industry data from Qualtrics; insurance industry data from Rocket Referrals.

Our father recently illustrated this point. He owns a lawn and garden store in our hometown in SE Iowa and just switched the insurance for his business to a different provider for the first time in 25 years because he found insurance elsewhere that saved him over $1,000 annually. He called up the agency he’d been with for a quarter decade and told them, “Sorry, but I can save a thousand bucks, you understand.” When we asked him why it took 25 years to shop around, he said it was because the agent he’d been working with there left last year, and he hadn’t heard anything from the agency since then. The former agent would stop by his store every time he was in the area just to check in and say hi. He liked the guy—his agent felt like a friend. Nobody wants to cut off a relationship with a friend, even if maybe it costs them a few extra bucks.

The moral of the story is to send communication to clients that makes them feel like your friend. Make it so awkward for them to end their relationship with you that it prevents them from ever shopping around. At least once per year, invest in your relationship with each client. We recommend birthday and holiday cards. The same rule applies here: the more automated it feels, the less impactful it will be.

An invaluable tool

The NPS is a great tool to help agents increase client retention. When insights from it are implemented over time, agents stand to raise their client retention significantly—from uncovering detractors to guiding future client communication to making changes at their agency that will turn more clients into promoters.

|

Learn how Rocket Referrals can help your agency implement the NPS and improve your score automatically |