This article explores the pain points of handling physical payments for an agency, the benefits of offering a digital payment solution to your policyholders, and tips from industry experts at Agave, Simply Easier Payments, and Xpress-pay on choosing a worthy provider.

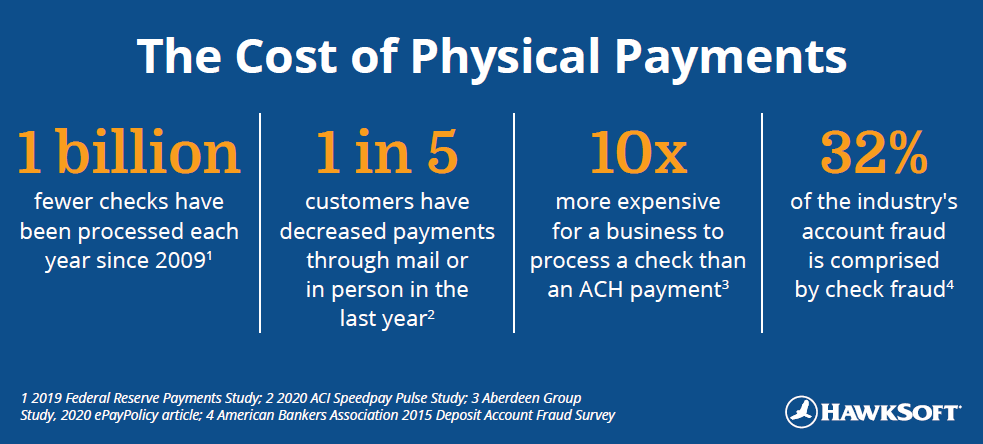

Modern consumers are used to making instant online purchases, and when it comes to paying for bills and services, they want digital payment options rather than physical payment methods like cash or paper checks, which are being used less and less. A recent report from the Federal Reserve shows that the number of checks processed has declined by over 1 billion checks a year since 2009—at which rate checks will be rendered completely extinct by 2026. ACI Speedpay Pulse found that 1 in 5 consumers has decreased their payments through the mail or in person at the biller’s location in the last year, with 1 in 4 increasing their usage of the biller’s website to pay bills.

In short, your clients expect digital payment options. Unfortunately, there are a number of obstacles that make online card and ACH purchases nearly as difficult for agencies to handle as physical payments. Digital payment solutions aim to solve these problems, allowing agencies to accept payments quickly, securely, and efficiently.

This article at a glance:

- The payment problem

- The solution: digital payments

- Choosing a digital payment provider for your agency

- The future of digital payments

The payment problem

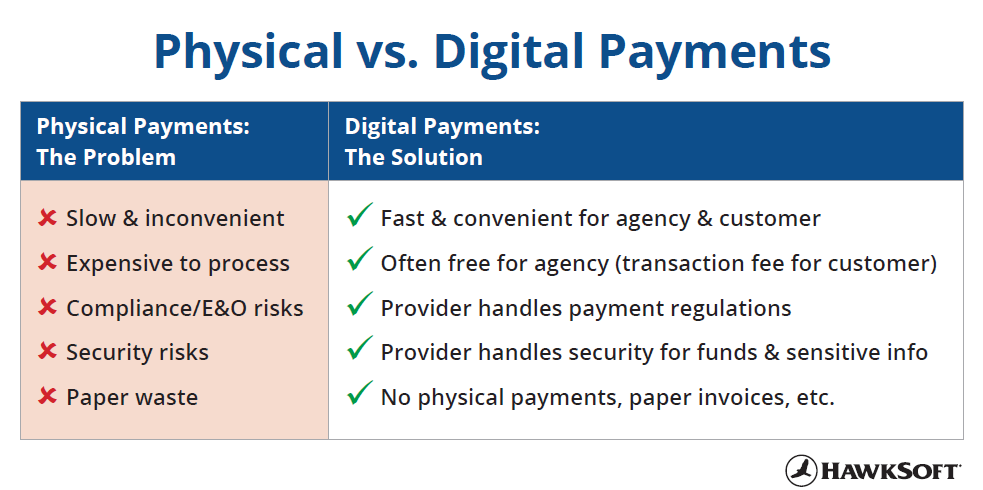

Handling payments—whether they’re cash, check, card, or ACH payment—presents a myriad of difficulties for an agency. Payment methods like cash and check are slow and present security risks, while accepting card payments involves navigating complicated fees and regulations. Here are some of the biggest pain points in handling customer payments.

Slow & outdated payment methods

Many payment methods are a hassle for an agency to accept, since they are not real-time and take several steps to validate before you actually receive the payment. Cash and checks have to be deposited at the bank and are dependent upon business hours. Plus, checks and even online ACH payments aren’t validated upfront, so you don’t know if something is wrong with the payment until the end of the process.

Expense

Accepting paper checks is expensive and time-consuming. The Aberdeen Group found that processing a check costs a business ten times more than an ACH transfer, and receiving a check costs five times more than an ACH payment. Debit and credit card payments are far more convenient, but they involve a host of fees, which eat into your agency’s bottom line.

Compliance/E&O

The fees and regulations associated with credit and debit card payments are complex and vary from state to state—and your business could quickly get into legal trouble if you’re not acting in compliance with them. With checks or cash, you could run into E&O problems if you receive a payment in the mail or dropbox that isn’t clearly marked, but may constitute the binding of a policy.

Security Risks

The amount of handling involved with paper checks provides multiple points for payment information to be leaked or stolen—check fraud accounted for 32% of the industry’s account fraud in 2014, according to the American Bankers Association. Storing your clients’ digital payment information is a risk for your agency too, due to the ever-increasing threat of cybersecurity breaches.

The solution: digital payments

Using a digital payment provider to handle your payments eliminates these problems and the headaches that come with them. Clients can make credit or debit card payments in real time, and ACH or e-check payments replace paper checks and cash. The payment provider takes on the risk of handling sensitive payment information through their own secure system, instead of riskier environments like phone or email. They handle the compliance and regulations for processing card payments and pass the transaction fee to the customer, who can choose to pay for the added convenience of a card payment or select a different method. Because they make their money from transaction fees, some providers even offer services to businesses for free. Considering the benefits they provide to both the agency and the client, digital payment providers are the best solution for handling payments.

Benefits of digital payments:

- Faster payment receipt, reconciliation, and binding of policies

- Better security for funds and payment information

- More convenient for customers — choice and flexibility in payment method

- Uses less paper — no physical payments, paper invoices, etc.

Choosing a digital payment provider for your agency

There are a host of digital payment providers available, so how to choose the best one for your agency? We asked several of our friends in the digital payment industry what agencies should look for when choosing a provider, and organized their advice into two categories: insurance industry specifics and general considerations.

Insurance industry considerations

Insurance is a unique and complex industry, so it may be helpful to consider payment providers who are specific to insurance and are familiar with the challenges it presents. Here are some insurance-specific concerns to consider when looking for a digital payment provider, whether or not they specialize in insurance.

Provider type

There are two main types of payment providers: item sales providers, which offer services and online cart experiences for sites with physical products, and service payment providers, which are focused on one-time or recurring bill payments. Independent agencies fall under the latter, so limiting your search to service payment providers will provide you with the best options.

Contract & fees for agency

Duke Williams, President of Simply Easier Payments, shares his advice for agencies: “One of the most important questions for independent agents is whether their payment provider adheres to each state’s insurance laws.” He points out that some state insurance departments, such as New York’s, have ruled that in order for a payment provider to charge a fee to the end customer, the provider cannot charge the agency any fees (such as monthly fees, chargeback fees, etc.), and the provider cannot have a contract with the insurance agency. This is why some payment providers don’t have any cost for the agency to use, instead charging a small transaction fee to the end customer.

“One of the most important questions for independent agents is whether their payment provider adheres to each state’s insurance laws.”

- Duke Williams, Simply Easier Payments

Handling of premium trust accounts

State insurance laws also dictate how a payment provider handles the funds in your agency’s premium trust account, such as how long a payment provider may hold premium funds. Ask potential payment providers how they handle premium trust accounts to ensure they operate in accordance with the regulations for the state(s) in which you do business.

Management system integration

Keep in mind which providers integrate with your agency management system. This kind of connection will pass client information to the payment system, so you don’t have to re-enter information when creating invoices and performing other tasks. HawkSoft’s HawkLink feature, for example, can be used to map data from HawkSoft to fields on your payment provider’s site to prefill client data for you, and HawkSoft is currently working with several payment providers to provide more robust integration in the future.

General considerations

Here are some more general issues to consider that aren’t specific to the insurance industry but will help you choose a worthwhile provider.

Payment limits and restrictions

Look for providers that accept all card and ACH types, which will give your customers the most flexibility in payment, especially now that COVID-19 has made other payment methods more difficult. You may also want to look for a provider that has no transaction minimums or limits, ensuring that you can receive payments for any amount.

“COVID-19 has changed the world. Now is the time for agencies to consider their Brand and Policy diversity to open new opportunities,” says Greg Mallin, Chief Revenue Officer for Agave. “To support this wave of new business, agencies must have forward-thinking partners who can deliver a digital payments experience across any channel and payment option.”

“Agencies must have forward-thinking partners who can deliver a digital payments experience across any channel and payment option.”

- Greg Mallin, Agave

PCI compliance

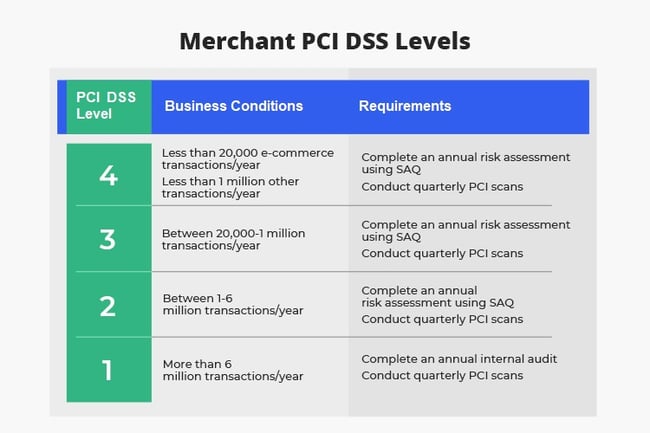

All agencies who choose to accept credit cards are required to select a provider who meets the Payment Card Industry Data Security Standards (PCI DSS). There are four levels of security requirements, which depend upon how many transactions are processed by the provider.

Kristy Dowell of Systems East, Inc. (Xpress-pay) recommends agencies look for payment providers that meet and maintain PCI Level One certification. This is the highest level of security possible, requiring a hardened environment with encryption and annual certification by an industry-approved third party security auditor. “Achieving and maintaining Level One certification is arduous and expensive for providers,” she says, “but it’s vital to protect the clients and thousands of customers who place their trust in them.”

You can search a provider here to see their certification status, and Kristy also recommends checking your provider annually to make sure they maintain their certification. If a breach occurs, she notes that industry penalties for not maintaining PCI compliance or using a payment provider that is out of compliance are steep, starting at $10,000 per agency. Card brands will also charge the agency to replace every card that was “stolen,” currently $50–100 per card.

“Achieving and maintaining Level One certification is arduous and expensive for providers, but it’s vital to protect the clients and thousands of customers who place their trust in them.”

- Kristy Dowell, Systems East, Inc (Xpress-pay)

Autopay/recurring payments

Many providers give customers the ability to set up autopay for recurring payments, so your clients can set up their payment and have it automatically withdrawn from their preferred account.

Payment access & branding

Make sure the provider makes it easy to generate payment links and add them to invoices or other necessary documents. Some providers even have a Pay Now button that you can add to your website. Check whether the provider allows you to customize the payment portal and other elements of the experience with your agency’s own branding.

Notifications

Some providers allow you to send automated email or text reminders to clients to remind them of an upcoming payment or confirm their autopay.

Reporting and reconciliation

Choose a provider that makes it easy to report on and reconcile payments. Look for features like the ability to receive notifications when payments are made or received, or to set up conditional payments, which allow you to review and accept a payment before it is processed to mitigate E&O concerns.

The future of digital payments

Digital payment management is starting to make its way to other areas of the industry as well, with carriers adopting it for claims payment. A survey by Engine Insights and VPay of consumers who had filed an insurance claim in the last three years found that while 60% of respondents received their last claim payout by paper check, more than 95% said that ease and speed of payment affected their satisfaction with an insurer, and over half would be willing to switch insurers to gain access to instant claim payment (Insurance Thought Leadership).

Digital payments are transforming the way we do business in the insurance industry and everywhere else. It isn’t the payment option of the future anymore—it’s the payment option of today, and if your agency doesn’t offer it, you could lose current and potential clients. Adding a digital payment solution to your agency’s offerings will help you minimize the pain points of handling payments while offering your clients the convenience of digital transactions.

Looking for a digital payment provider?Friends of HawkSoft in the digital payment industry: |