An insurance agency network (which you may also hear called a cluster, aggregator, alliance, or producer group) can provide a valuable partnership for an independent agency, especially in the current hard market where it’s more difficult than ever to access carriers and gain direct appointments.

A network is a group of agencies that combine their business for one or more carriers in order to qualify for improved commissions and bonuses from carriers, get access to additional carriers or opportunities, and make use of other agency resources as a larger group. With greater volume, the larger group can negotiate more favorable terms than any single agency would be able to on its own.

While networks vary widely in their business model, requirements, and the benefits they offer, this piece provides a general guide to help independent agencies understand what networks do and what to look for when choosing a network partner.

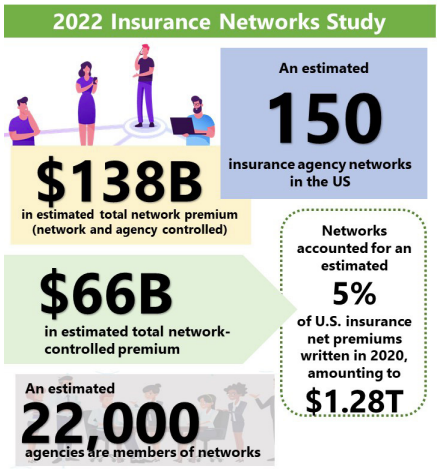

Source: 2022 Insurance Networks Study (Insurance Networks Alliance)

Source: 2022 Insurance Networks Study (Insurance Networks Alliance)

In this article:

- What are the benefits of joining a network?

- How is a network different from an association?

- Common network models

- What to consider when evaluating network partners

- Network resources from HawkSoft

What are the benefits of joining a network?

What each network offers its members is different, but most benefits fall under three main categories: improved carrier access, increased commissions and bonuses, and agency resources.

Improved carrier access

Members of a network typically gain access to a greater variety of regional and national carriers, as well as specialty and E&S markets. Members may receive access to a carrier through the network until they have the volume to get their own direct appointment, which allows agencies the opportunity to utilize carriers they wouldn’t have the volume to write with otherwise.

Higher bonuses and commissions

Networks can negotiate more advantageous agreements with carriers due to the group’s large combined volume, meaning that members may be able to receive higher commission rates and performance-based bonuses than they would as an individual agency. This can give new agencies the potential to start earning bonuses right away, even if they don’t have much premium yet. Plus, the loss ratio is spread out across a larger group, so a catastrophic loss at one agency affects the whole group minimally instead of one agency drastically.

Source: 2022 Insurance Networks Study (Insurance Networks Alliance)

Agency resources

Networks are more successful when their members are successful, so they may have resources available to help agencies grow. This could include things like technology partnerships or discounts, training or educational programs for members, market placement assistance, sales and marketing support, help with compliance, or assistance with agency valuation for buying or selling an agency.

HawkSoft agents on benefits of joining a network

How is a network different from an association?

Networks are sometimes confused with insurance associations (such as Big I or PIA), which are also made up of groups of agents. However, associations have a very different purpose and provide different benefits to the agency. Associations represent the interests of their members (which could include insurance agencies and brokers, carriers, and others in the industry) to governing bodies and other entities, at the state or national level. Associations are focused on advocacy rather than carrier access, and may lobby for legislation, provide education or training, help create industry standards or best practices, and more. Subsequently, agencies will often be a member of both a network and an association as they provide different benefits.

Common network models

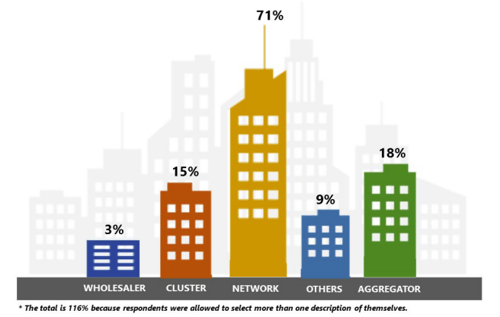

There are many different network structures or models, and like independent agencies themselves, each network functions differently and has its own unique combination of requirements and benefits. These general descriptions of a few of the most common models for networks may be helpful in understanding the different ways in which networks operate. Please keep in mind that the terms provided here are often used interchangeably by both agents and the organizations themselves, so it’s important to understand how each network functions rather than relying solely on these terms as classifiers.

Survey question to networks:

How do you describe your organization?

Source: 2022 Insurance Networks Study (Insurance Networks Alliance)

Source: 2022 Insurance Networks Study (Insurance Networks Alliance)

Cluster

A cluster is generally the least structured type of network, often being self-managed by its members. Members may combine their volume for only a single carrier or market, and are free to operate as they wish with the others. Members usually maintain ownership over their book of business and operate independently, so clusters may offer fewer resources outside of carrier access.

Aggregator

Aggregators tend to have more structure and a wider scope than clusters, with members potentially combining volume for multiple markets. These groups usually provide a broader range of market access for agencies, with the aggregator often holding the carrier appointment but the members retaining ownership of their book of business either completely or partially, depending on the contract.

Network

A true network is typically more structured and involved with its members than a cluster or aggregator, providing comprehensive resources and offering more of a guided pathway to agency growth. Networks may offer a range of contract options for members, anywhere from the agency retaining book of business ownership to total buyout by the network. Networks also vary in the level of structure they provide; some function more as franchises, where members come under the umbrella of the master agency and use their branding and resources, while others allow for more independence for the agency. Networks typically have dedicated employees who are available to support the members.

What to consider when evaluating network partners

Because networks vary so widely from one to another, it’s important to know what to look for when considering which network to join. Joining a network is an important business decision that can have a huge impact on your agency, and contracts may last multiple years or dictate book of business ownership, so make sure you fully understand what you’re agreeing to before you sign! Here are some of the most important things to think about when considering networks.

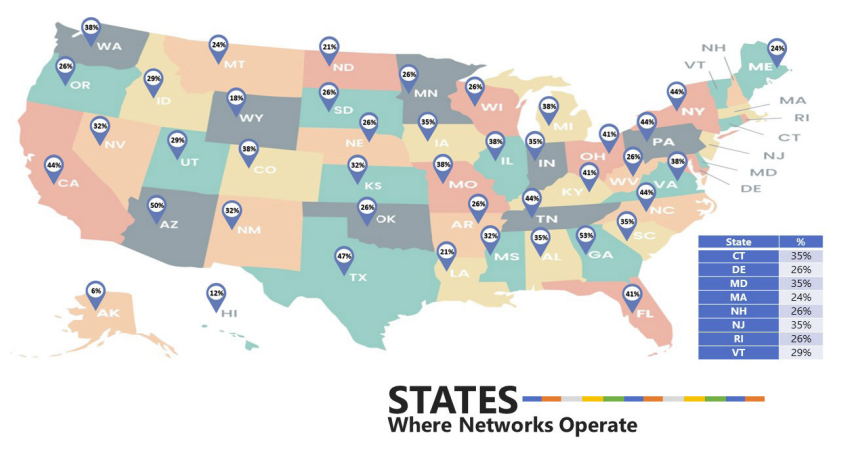

Region

While some networks are national, many focus on a specific state or region. Make sure the network serves all states you write business in or may expand to in the future. If it’s a national network, see if it has a chapter for your state or region, which might provide you with more relevant carriers and resources.

Source: 2022 Insurance Networks Study (Insurance Networks Alliance)

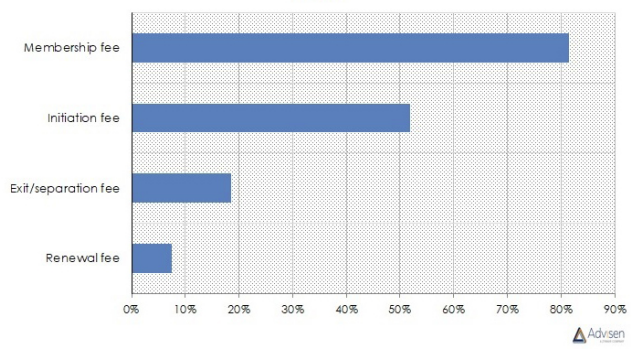

Fees

All networks function differently when it comes to membership fees. A network may require one, some, or all of the following fees—ask the network which of these apply.

- Initial startup, buy-in, or franchise fee

- Recurring monthly, quarterly, or annual renewal fee

- A percentage of the agency’s total commission volume and/or bonuses

- Exit/termination fee or book of business buyout upon leaving the network

Survey: Fees required by networks

Source: 2022 Insurance Networks Study (Insurance Networks Alliance)

Source: 2022 Insurance Networks Study (Insurance Networks Alliance)

Carriers

When it comes to carrier access, there’s more to consider than simply reviewing a list of included carriers. Make sure to consider the following questions regarding included carriers and how your agency will access them.

- Which carriers does the network provide access to?

How many carriers are included? Are the carriers in the right region and markets for your agency? Does your agency already have direct appointments with any of these carriers—and if so, does the network provide more favorable terms?

- Do members access carriers through the network’s appointment, or do members receive their own direct appointment?

Networks may start members with the network’s appointment and allow them to earn their own direct codes once they reach a certain volume. This will determine whether the agency’s name or the network’s name is used on policies (which can affect the value of a book of business), and whether submissions will be sent to the network for carrier placement, so make sure you understand how carriers are accessed.

- How well do the network’s carriers perform?

How long have the carriers been with the network? Is there high turnover? What is the average premium per carrier? Is it increasing year over year?

- Do all the agency’s carriers need to go through the network, or can some stay under the agency?

This could affect current appointments you already have with carriers, or possible future appointments.

Survey: Top personal & commercial markets offered by networks

Source: 2022 Insurance Networks Study (Insurance Networks Alliance)

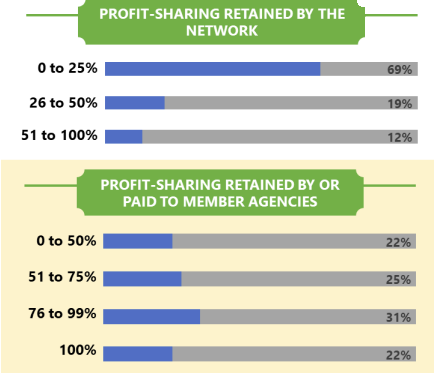

Commissions & bonuses

In addition to knowing what carriers are available, understanding the commission and payment structure is vital. Start with the following questions:

- What commission rates are offered for carriers?

- Are these rates higher than direct appointments your agency may already have?

- Does the network provide profit sharing bonuses?

- What percentage of total profit sharing is shared with members? Are there qualifications to receive these bonuses (such as loss ratio)?

- Are any other financial incentives offered, such as quarterly performance incentives?

- How and when are payments distributed?

- Is the agency paid by the network, or paid directly by the carrier?

- Does the network take a cut of bonuses or commissions?

- What is the net gain for your agency?

Survey: Profit-sharing benefits of networks

Source: 2022 Insurance Networks Study (Insurance Networks Alliance)

Source: 2022 Insurance Networks Study (Insurance Networks Alliance)

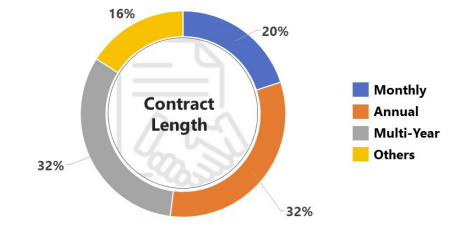

Agency ownership

One of the most crucial things to understand when entering into an agreement with a network is whether the network will have full, partial, or no ownership over your agency’s book of business. This can have a huge impact on your agency’s valuation and any plans to sell the agency in the future. If the network has a stake in the agency, understand what this means and what requirements, if any, may be asked of the agency in return.

In addition, understand what happens if you terminate the agreement in the future:

- Is there a contract term? How much notice is required if you want to leave?

- Is a termination fee or buy-out required?

- Can you continue business with the same carriers after you leave the network, or are there any non-compete restrictions?

- What role does the network play if you choose to sell the agency? Will the buyer be required to continue the network contract?

Survey: Network contract length

Source: 2022 Insurance Networks Study (Insurance Networks Alliance)

Source: 2022 Insurance Networks Study (Insurance Networks Alliance)

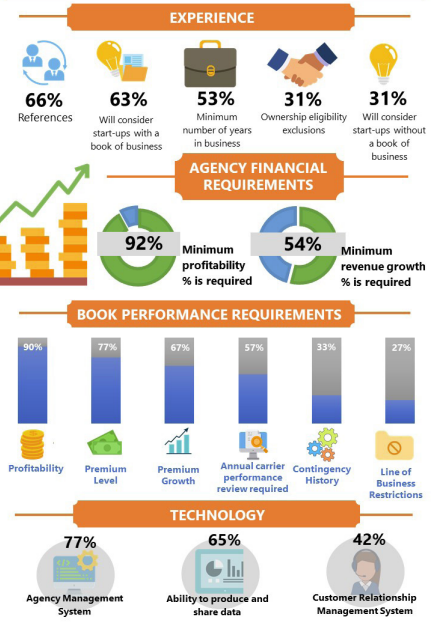

Contract requirements

See if the network requires certain agency or book of business demographics, premium requirements, etc. for its members. Make sure you understand the level of structure the network will impose upon your agency as well – will the agency be required to use specific technology or processes, adhere to certain branding, or report on KPIs to the network? New agencies may want a greater level of structure and support than established agencies. Make sure these things align with your agency’s needs, desires, and goals.

Survey: Network membership requirements

Source: 2022 Insurance Networks Study (Insurance Networks Alliance)

Source: 2022 Insurance Networks Study (Insurance Networks Alliance)

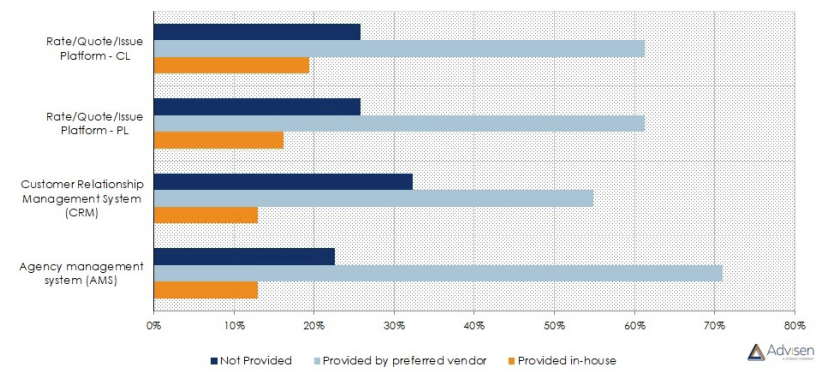

Support & resources

Research what kind of resources and support the network provides, and how much value this offers for your agency. You may want to think about the following:

- Does the group offer educational resources or programs?

- Is support staff available to answer questions and guide you through the onboarding process?

- Is consulting available for placing difficult risks?

- Does the group provide guidance, recommendations, or discounts for technology or other agency necessities?

Survey: Technology offerings from networks

Source: 2022 Insurance Networks Study (Insurance Networks Alliance)

Stability & leadership

Finally, it’s important to know and trust the group you’re doing business with. The following questions can help shed light on whether a network will be a good fit as a partner for your agency.

- Who is the owner? Has ownership remained stable, or changed hands?

- Do you trust the network and its leadership? Do your values align with theirs?

- How (and how frequently) does the network communicate with members? Are there channels for providing feedback?

- What do current and past members say about the network?

Network resources from HawkSoft

HawkSoft is proud to work with a wide array of networks to provide education and resources for their members. We've now added Michael Ley (mley@hawksoft.com) to our team as Director of Network Relations, to serve as a direct liaison with networks. We have also created a Network Partners page that lists some of the networks HawkSoft works with. Feel free to use this resource to contact and learn more about potential network partners for your agency.

Additional resources on insurance agency networks

- 2022 Insurance Networks Study (Insurance Networks Alliance)

- What Agencies Should Know Before Joining and Insurance Agency Network (Insurance Journal)

- Guide to Selecting an Insurance Agency Network (Agency Equity)

- The Truth about Insurance Agency Networks (Rough Notes)

- 9 Ways to Evaluate Agency Networks (Iroquois - network)

- Choosing an Insurance Agency Network (Smart Choice – network)

- Joining an Agency Network, Aggregator, or Cluster (Smart Choice – network)