Guest blog by Ryan Mathisen, GloveBox

Guest blogs are written by contributors outside of HawkSoft. The author's views are entirely their own and may not reflect the views of HawkSoft.

Insurance agents, how many Insurtech ideas do you come up with every single week in the flow of your weekly hustle?

I talk to countless agency owners daily, and 90% of the conversations turn from GloveBox to, "you know, I had an idea a couple of months back." Then they proceed to pick my brain on how we took GloveBox from a concept to a reality. Honestly, I love it! Who better to change our industry than the ones who are driving in the revenue? They always ask me the number one thing that I have learned on this journey, and my answer is always the same: for every great solution that is being built to solve a pain point in the industry, two to three new problems are created around it.

My overlying point is, until the core, innovative Insurtech products come together and operate as a cohesive unit, the "transformation" they offer is simply a temporary solution, not lasting change. This article discusses the obstacles to that change and how agents can identify truly transformative Insurtech solutions.

This article at a glance:

- The InsurTech disconnect

- Legacy technology

- Insurtech implementation resources

- Agency adoption

- The benefits of carrier connection

- Automated communication

- Self-service options

The Insurtech disconnect

The truth is, a cool new CRM that doesn't talk to an agency management system, an automated marketing system that doesn't talk to a CRM, or an innovative mobile client platform that doesn't talk to either is not a true solution for your agency. So why are so many new platforms being created without that crucial functionality? There are several roadblocks to creating connected technology in the insurance market.

1. Legacy technology

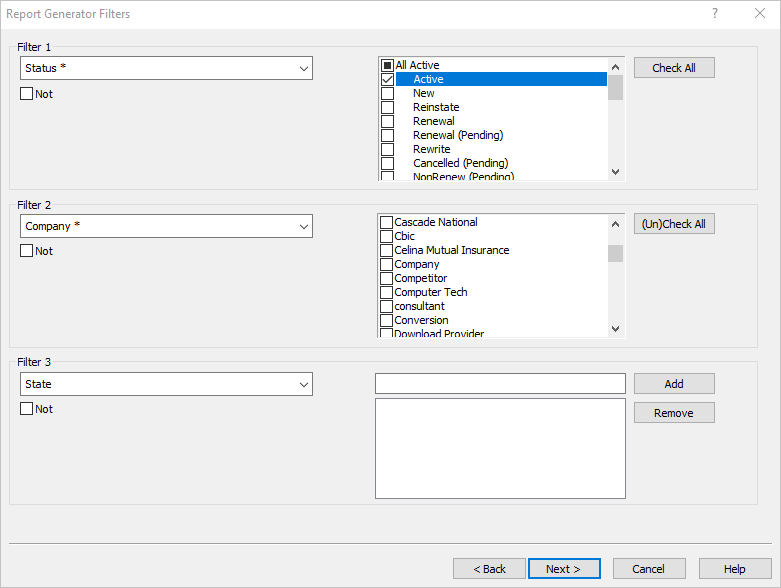

The incumbent systems where data is housed, such as agency management systems and carrier technology, are not always willing to collaborate with fresh technologies. While some seem very open to integrating, as they understand their core values to the market and see where partnerships can increase viability, others are fairly closed off from integration. Who loses in the latter? The agencies who are using their products. They are held captive to the shortcomings of what they have committed to and are left to piecemeal the rest with clunky workflows and manual processes. See HawkSoft’s blog on data ownership to learn more about why it’s important to work with technology providers who allow you to freely pass your data between the systems where you need it.

The incumbent systems where data is housed, such as agency management systems and carrier technology, are not always willing to collaborate with fresh technologies. Agencies are left to piecemeal clunky workflows and manual processes.

2. InsurTech implementation resources

A day in the life of an Insurtech startup consists of a 14-hours-a-day, 7-days-a-week sprint to achieve viability in the marketplace, which makes it seemingly impossible to work on initiatives like integrating with another Insurtech platform who is running the same sprint. I can tell you firsthand, I easily come across 5 platforms a week that could be a huge value-add. But the reality is, we are 6-12 months away from being able to implement initiatives like that. So, who loses in this scenario? The agencies who are using multiple insurtech platforms that have zero operational synergy.

3. Agency adoption

Over the past 18+ months here at GloveBox, myself and the team have met with the most technologically diverse group of agency owners imaginable. Some are so in tune with the technology offerings in our space that they could write a book on it, while others struggle to simply get connected on a Zoom call. As innovators we understand the median tech IQ of agency owners and what their appetite is for new technology. While there are agencies out there that are thirsty to revolutionize their business structure with innovative automation and AI solutions, we found that most tend to hone in on certain pain points within their process and solve them methodically with core solutions.

The benefits of carrier connection

Let's grade our current landscape of innovation around InsurTech. While there is absolutely no shortage of fresh concepts and technologies being introduced to the market, and for that we get a solid A, when we look at the cohesion of these concepts in the pursuit of a true ecosystem, we get a D-. In my opinion, we have a long way to go in unifying our solutions into one harmonious ecosystem that will quench the innovation thirst of our agencies, carriers,and policyholders for the next ten years. But do I think this goal is attainable? Without a doubt!

While there is absolutely no shortage of fresh concepts and technologies being introduced to the market, we have a long way to go in unifying our solutions into one harmonious ecosystem that will quench the innovation thirst of our agencies, carriers, and policyholders.

So what should Insurtech platforms focus on in order to build toward that A+ ecosystem? For GloveBox, it’s carrier connections. By forging a direct connection between carriers and agency systems via API, GloveBox goes beyond other technology “solutions” that are siloed from the rest of your agency’s workflows. GloveBox provides a truly integrated approach to managing your policies, where your management system, CRM, and insured portal work in sync with carrier systems to provide your clients with the best service possible. Here are some of the biggest benefits of a carrier-integrated system.

Automated communication

A carrier-connected platform allows your policyholders to truly achieve self-servicing capabilities on tier-one service requests. It can tell your CRM to automatically notify customers of late pays, pending signatures, pending inspections, or even claims updates pushed directly from the carrier.

How much time, money and resources would a technology like this free up within your organization? Valuable resources could be pivoted towards increased revenue-generating activity.

Self-service options

In this day and age, your client doesn’t want to have to request to make a payment. They want to simply make a payment. A platform that connects clients directly with the information they need from their carriers will cater to the needs of customers who prefer to self-serve. If even 50% make use of these options, how much impact does that have on your business? Instead of your valuable CSR team spending countless wasted hours of time on mindless activities, they can utilize their high-level retention and cross-sell skills on the clients who prefer to call the office and talk to a human.

Choose connected solutions

Insurtech “solutions” that don’t have the ability to interface with all levels of your agency’s tech stack are not true solutions. Look for carrier-connected platforms that can truly make the lives of your agency staff—and your clients—easier on every level. GloveBox can and will achieve this level of technology for you and your agency.

You have the power to help push more carriers to interface with technology solutions by talking to your carrier reps and contacts. Tell them how much self-servicing integrations with the platforms you use, like GloveBox and HawkSoft, would provide unbelievable value to your productivity and bottom-line revenue.

Together, we can build a truly connected technology ecosystem for agencies, carriers, technology providers, and clients.

Harness the power of carrier connection with GloveBox

|