Guest blog by Nick Cinger, Pathway

Guest blogs are written by contributors outside of HawkSoft. The author's views are entirely their own and may not reflect the views of HawkSoft.

Agents spend too much time communicating with their clients on an individual basis to complete tasks like policy renewal. A McKinsey report revealed that 30% of an agent’s workday is spent processing and dealing with paperwork. The report states that insurance professionals who rely on automated workflows to do the work on their behalf can improve efficiency by up to 80%.

One area where most agents can benefit from automation is renewals. Because insurance agents need to be able to connect with each client before the renewal date, this is largely done manually by members of staff. Insurance businesses invest a lot of time, human capital, and money into completing this task.

A McKinsey report found that 30% of an agent’s workday is spent processing and dealing with paperwork, and that insurance professionals who rely on automated workflows to do the work on their behalf can improve efficiency by up to 80%.

Realizing that this is a significant undertaking, a large number of insurance professionals have no choice but to be selective and only reach out to the segment of their clientele that is most important to their business. Agents have, therefore, adopted a reactive approach when it comes to client communication. This leaves a portion of their customer base unattended and, as a consequence, their retention rate suffers.

As is the case with all industries across the board in today’s rapidly evolving world of technology and innovation, automation is here to help. We’ll go over how automation benefits an agency, and how your agency can automate the renewal process.

In this article:

- Benefits of automation

- How to automate the renewal process

- Use relevant data points to automate renewal communications

- Leverage hyper-personalization to deliver coverage recommendation

Benefits of automation

Automating workflows streamlines the renewal process and allows agents to maintain an effective, clear line of communication with all of their customers. For example, Pathway’s data demonstrates that users with 7,000 - 8,000 clients save an estimated 10,800 USD per month by automating these time-consuming tasks.

Here’s what Leslie Willcocks, a professor of technology, work, and globalization at the London School of Economics Department of Management, has to say about the benefits of automation:

“In an insurer we studied, there was a particular process where it used to take two days to handle 500 premium advice notes. It now takes 30 minutes. The major benefit we found in the 16 case studies we undertook is a return on investment that varies between 30 and as much as 200 percent in the first year.”

Here are a few ways automation saves time and money for your agency.

Eliminate mailing costs

A significant number of agents are sending out pre-renewal and renewal letters via post. In Canada and the United States, the average cost of sending physical mail is 1.05 CAD and 0.65 USD respectively. This estimate takes into account postage fees, printing, and the cost of paper and envelopes. Having said that, agents using Pathway save an average of 3,045.0 USD per month because they are using email communication to complete the renewal process instead.

Reduce labor costs

Without the use of automation, a TSR or CSR would need to manually customize an existing template and send it out to each policyholder individually. That process has been shown to take around 4 and a half minutes per policy. Using Pathway, agents have reported saving an estimated 7,766 USD each month in labour costs.

Aside from the significant savings, there are several other benefits to using automation.

Re-invest time

Automating manual tasks helps agents save time and allows them to focus on other core aspects of their business, such as growing their network of clients.

Standardize processes

By standardizing the process by which they communicate with their clients, insurance agents are able to connect with each policyholder before the renewal date.

Mitigate E&O exposure

Agents can easily keep track of when renewal letters are sent out, as well as when they are received and opened.

How to automate the renewal process

One way for insurance agencies to avoid costly manual bottlenecks and scale their business growth is to rely on automation to do the heavy lifting on their behalf. Agents can use intuitive marketing automation platforms that have the ability to generate and deliver pre-renewal letters to each client, in a fraction of the time it takes them to do it manually. Here are some ways you can utilize an automation platform to take the manual work out of the renewal process.

Use relevant data points to automate renewal communications

A good automation platform can deliver email and text notifications to policyholders automatically based on information stored in an agency management system like HawkSoft.

For example, Pathway uses the following information stored in the management system to segment clients and automatically send them personalized, highly relevant emails. In fact, we sync the following data from the management system every 24 hours in order to ensure that all relevant policyholder data is updated to reflect changes that are being made by members of staff.

Policy information:

- Renewal date, effective date, expiry date, etc.

- Policy data

- Coverage data

Client information:

- Contact details

- Assigned executive or representative

- Address

Using these data points, agents are able to deliver pre-renewal letters to each client on time, with a personalized message. In addition, Pathway’s smart questionnaires enable clients to update their agents about any significant changes before their renewal date.

Leverage hyper-personalization to deliver coverage recommendations

The best automation platforms also use the client coverages in your management system to automatically deliver custom recommendations to each policyholder. In this manner, agents are able to see if they can do more business with their policyholders before the renewal date, and more importantly, ensure that each client is adequately protected.

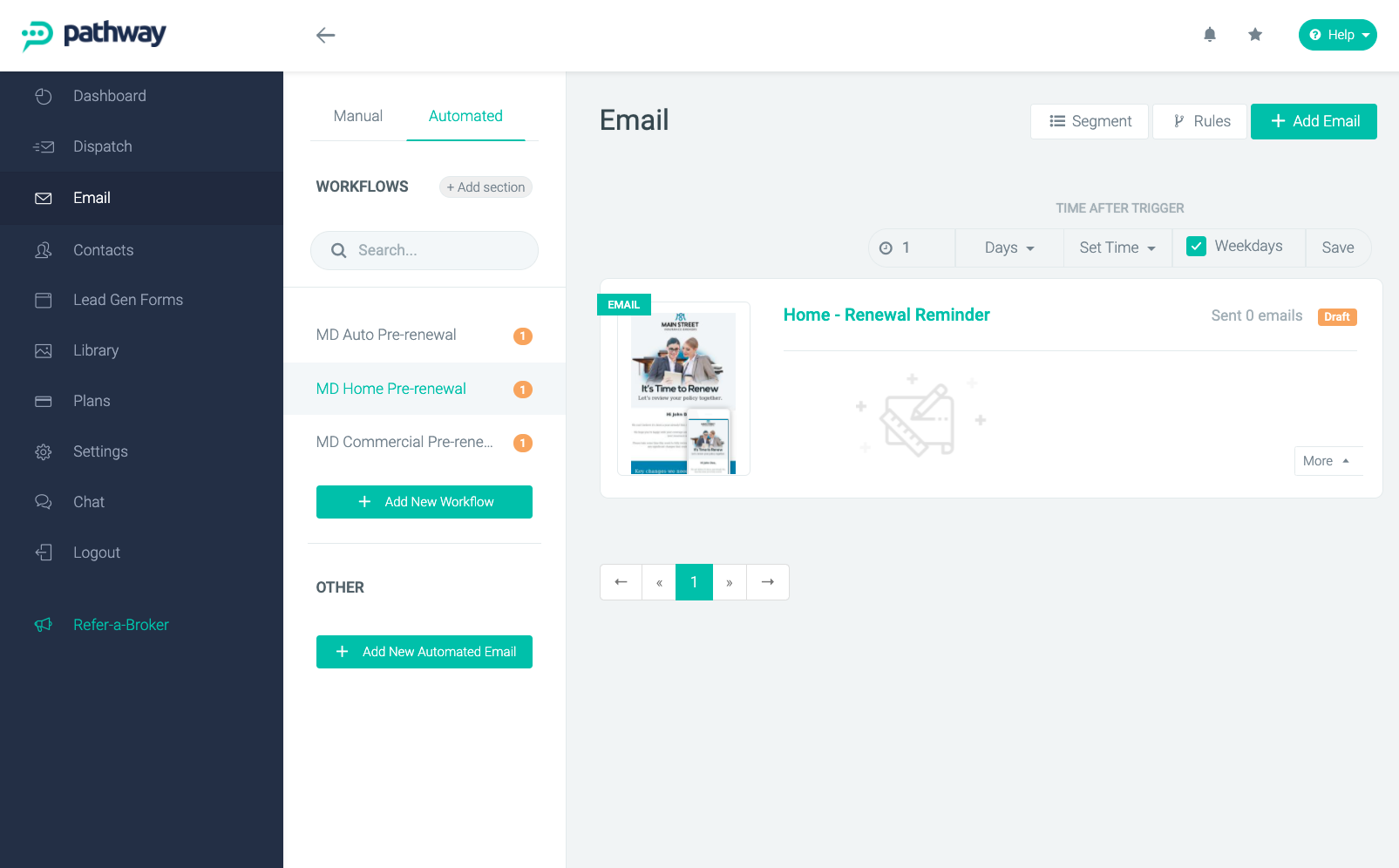

This core feature is built into Pathway and allows users to be very specific with the content they are delivering to their clients. Using merge tags, insurance agents are able to segment their entire client base in every email communication that is sent out, including pre-renewal letters.

Automated emails in the Pathway platform

Here are some real-world examples of personalized coverage recommendations that can be automatically generated and included in pre-renewal letters:

- Property policy: Sewage and overland water protection are offered to clients who do not have either.

- Auto policy: Clients with snow tires are offered a discount.

- Policy with a specific liability limit: Clients that have under $1,000,000 in coverage are recommended to increase their liability coverage or are offered an umbrella policy.

- Policy in a certain line of business: Clients are segmented by business codes as opposed to their coverage. For example, policyholders that have home and condo insurance are offered promotions for each policy separately.

- Policy issued by a specific insurer: Clients that have policies from a certain carrier are informed that their policy documents will be delivered electronically in the future.

Time is money—save on both

Automating business processes like renewal saves agents from the headache of back-and-forth communication with their clients, but it also keeps the policyholders happy. As Millenials are slowly entering the workplace in greater numbers, studies show that 84% of today’s consumers prefer to communicate via email as opposed to receiving a phone call from their insurance provider.

Maintaining clear and effective communication with every policyholder, whilst also giving them custom coverage recommendations, is only possible with automation—so choose a platform that suits the needs of your agency, and ultimately your clients.

Automate your pre-renewals with PathwayPathway helps agents take advantage of automated workflows that streamline complex insurance processes, allowing them to focus on more important tasks at hand. |