Guest blog by Raution Jaiswal, InsuredMine

Guest blogs are written by contributors outside of HawkSoft. The author's views are entirely their own and may not reflect the views of HawkSoft.

In 2022, insurance agents have a lot to look forward to. According to an October 2021 survey of over 500 agents and brokers by Aon Programs, about 70% of agents say they expect their business to grow this year, with 20% of that number anticipating “off the charts” growth. But we should talk about the 30% that aren’t growing, and those expecting only marginal growth. To reach their goals, agencies are reevaluating their strategies and taking a closer look at the resources they can use to develop and implement a growth plan that maximizes earning potential.

For many agencies, the key to reaching their forecasted growth lies in leveraging technology to streamline processes and harness valuable data, as well as ramping up digital marketing to meet current trends and reach a larger, evolving audience. While it seems like a huge undertaking for agencies without these practices already in place, there are easy ways for agencies to digitize processes and transform their operations. Agencies understand that the ways they used to grow in the past aren’t going to work anymore. The rapidly evolving insurance industry is affected by waves of retirement, lack of appeal to the younger workforce to replace those retiring, huge swings in premiums, and a lack of ability to keep up and scale for agencies over a certain age. Change is imminent, and efficiency is key.

In this article:

The shift in growth strategies

When it comes to where agencies expect to see their growth in 2022, there are a few key areas that many owners intend to target.

Product expansion

In the Aon Programs survey, 35% of agents said they plan to explore growth and adapt to changing customer needs by expanding their product offerings in 2022. The top three specialty lines agents intend to add products for are catastrophe, healthcare, and nonprofit coverage. Another dimension of product expansion is the option to cross-sell. If your offerings are unique and better than the competition's, it will be much easier to sell to current clients who will not only increase your profitability, but also retention and client stickiness.

35% of agents said they plan to explore growth and adapt to changing customer needs by expanding their product offerings in 2022. The top three specialty lines agents intend to add products for are catastrophe, healthcare, and nonprofit coverage.

Aon Programs survey

Client retention

It’s no secret that keeping customers is far less expensive than acquiring new ones. While client retention has always been an important part of any agency business strategy, agencies with a growth mindset are realizing the potential in investing in adding value and enhancing revenues with their existing book of business. By increasing customer retention by just 5%, you can increase your total revenue by 25-95% and increase profitability by double over a 5-year period.

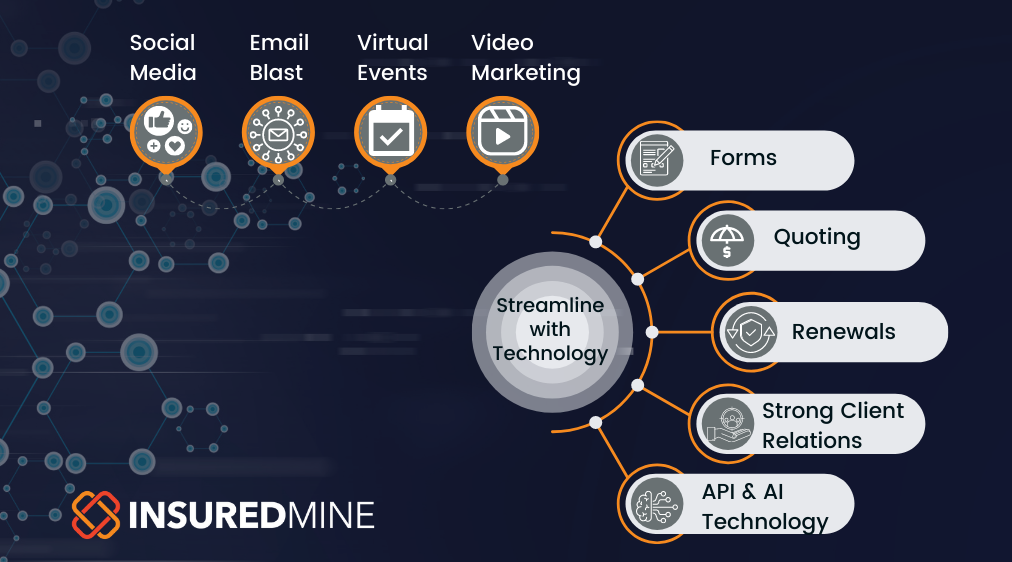

Leveraging new technology to solve business problems

Digital tools are helping agencies save a sizable amount of operating hours everyday on time-consuming manual and repetitive processes. Here are some tasks that can be streamlined with technology.

Forms

Some agencies still collect new customer information via paper forms called customer sheets, then type that information back into their CRM or management system. Needless to say, it is an inefficient manual process. Switching your data collection to a digital format not only saves your staff time on manual data entry, but also allows customers to access forms online on demand rather than waiting for an agent or CSR to mail or email paperwork to them. We all know customers are happier serving themselves than waiting for us to serve them—some classic examples of this are printing boarding passes for flights or using ATMs. When the data is entered into a digital form, it can be sorted and stored for other purposes and better analytics can be captured compared to the archaic paper format.

Quoting

The quoting process has undergone significant changes in the past few years, from quoting each carrier individually to quoting platforms for personal lines to the current push on commercial lines quoting platforms. This has enabled independent agencies to have better risk-writing capabilities with a larger number of carriers. This shift allows them to serve clients better and faster.

Renewals

The renewal process can be better managed with tech tools that monitor policies for renewal dates, automatically create workflow reminders for agents, import underwriting reports, check for coverage gaps and suggest complementary policies, and calculate premium rates. These tools can be set to generate customer communications, policy documents, and invoices.

Strong client relations

Strong client relations

Technology tools can help you improve your client relations by automating customer communications and creating workflows for contact reminders. Agents won’t have to worry about missing a follow-up deadline or losing a client message in the shuffle. You can use technology to set automatic contact reminders at intervals you set or policy milestones, and you can also create customer communications channels that will collect messages and inquiries and sort them to the appropriate staff member for action.

APIs and AI

Application programming interfaces and artificial intelligence can help agencies provide a level of customer service that just isn’t otherwise possible with the other daily demands on agents and staff. These tech-based tools can be things like chatbots on your website that can engage in conversation with visitors, learn their needs and preferences, and direct them to policies and product offerings that can be of value to them.

Marketing strategy in a virtual world

The last two years have caused a shift in the way many businesses strategize marketing to meet evolving audience behaviors and expectations. Here are some of the marketing tactics expected to be used in insurance agent marketing strategies this year.

Social media

40% of the agents who responded to the Aon Programs survey said they intend to use social media in their 2022 marketing strategy. You can use social media to communicate with past and current clients and engage with potential ones. Additionally, social media is a great way to market sales, educate on policy types, and offer advice that can position you as an industry subject matter expert.

Email blasts

Like social media, email marketing is a good opportunity to add value and build trust with your clients by sharing important insurance knowledge and information. Regular email communications also keep you front-of-mind among current clients and prospects. 22% of agents surveyed said they will use email marketing this year.

Including just one video on a webpage can increase conversions by 80%.

TechSmith

Webinars, virtual events, & podcasts

Since 2020, many businesses have relied on webinars, virtual events, and podcasts as a way to connect with audiences they could no longer reach in person. That year, webinars and Zoom events were the top tactic in the Aon survey. However, as Zoom fatigue becomes a growing concern among event organizers, virtual events have fallen down the list of insurance agent marketing priorities for 2022.

Video marketing

Video marketing has become an effective tool in insurance marketing to build trust and credibility, increase visitor engagement, and drive conversions. Including just one video on a webpage can increase conversions by 80%. Using video can help streamline your marketing campaigns and make it easier to track ROI when done correctly.

Streamlining operations for efficiency

When you focus on streamlining your agency operations and driving efficiency, you’re also boosting your bottom line and increasing profitability. All of the examples below can help save your agents time to reinvest in selling activities or reduce the number of hours needed for customer support staff.

Streamline processes

Your agency probably has practices and procedures in place that can use some revamping. Assess your workflows and processes and look for opportunities to eliminate low-value tasks and free up your staff for more profitable activities.

Increase automation

Adding more automation to your workflows can not only give your agents back more time for high-value tasks, but can make it easier to train new staff when necessary. Bottlenecks in service time can be identified and resolved more easily.

Scale with standardization

Standardizing your processes can reduce data errors and increase the overall quality of your products and services. It can also give you a better understanding of your true capacity and ability to scale your operations.

Tapping the data well

Data is the oil of the 21st century—those who have it hold an extremely valuable resource and an opportunity for incredible profit. Leveraging data can help you better understand your customers and help evolve your agency. Tools that help you understand and track customer segmentation, policy data, premium data, renewals, and loss ratios will help you improve both the functionality and profitability of your agency.

In today's digital world, technology tools are critical for an agency's success. Make sure your agency has the tools it needs to provide the efficiency, analytics, and superior customer experience that will help your agency achieve its growth goals.

Transform your insurance operations with InsuredMineInsuredMine is the all-in-one insurance technology platform designed to leverage data and streamline operations so your agency can grow. With a robust offering of automated features—as well as a high degree of visibility into your agency, your team, and your clients—it’s easy to see why InsuredMine has been ranked the #1 insurance renewal software on the market. |