Guest blog by Cam Bob III, Infinity Leads

Guest blogs are written by contributors outside of HawkSoft. The author's views are entirely their own and may not reflect the views of HawkSoft.

With digitization being at the forefront of conversation for most industries and a growing number of Insurtech startups sprouting up, you might have heard the term digital insurance agency being thrown around.

So what exactly is a digital insurance agency?

Simply stated, it’s an agency that is well positioned to compete in a digital age where Insurtech giants and startup disruptors are clamoring for the biggest piece of the pie.

Digital insurance agencies understand what makes Insurtech startups successful and apply those lessons to their own businesses. They are lean organizations that focus on customer experience and have strong digital footprints. They invest in digital infrastructure and assets. They create a culture of innovation like tech startups. They attract and nurture leads online. And as a result, they are positioned for rapid revenue growth and longer customer retention because they’ve adapted to business in the digital era.

This article at a glance

Why should your agency make the shift?

Satisfy a changing customer base

Customer expectations of instant digital transactions sustained seamlessly across digital channels are increasingly the norm. And with these changes, so change the expectations for their insurance service provider. Modern consumers are spoiled with choice; they live and breathe on their digital devices, and oftentimes with the depth of information available online, they make purchase decisions prior to even engaging with service providers. Studies show that most consumers will use their computer or mobile device to perform online research before they engage directly with your brand.

Attract young talent

Consumers aren’t the only ones becoming more digitally savvy. The industry’s up-and-coming talent is too. To address the talent gap in the industry, you’ve got to shift perceptions amongst recent graduates and leverage new channels for recruiting, or you risk losing the best talent.

Stay competitive

Insurtech startups are lean, digitally native, innovative, and have venture capital backing. Already in 2019 Insurtech startups have received record-breaking venture capital investment globally, and the year is not over. In addition, 56% of Insurtech startups are focused on marketing and distribution. It is safe to assume that the techies and venture capitalists have your book of business in their crosshairs.

Insurtech may have the funding, reach, and technology to be a formidable opponent in the insurance space, but there are massive opportunities to be exploited for agents who can effectively combine the traditional and digital. With the rapid advancements in technologies like automation, artificial intelligence, and digital marketing, digital tactics have become accessible and possible to leverage for independent agencies of any size.

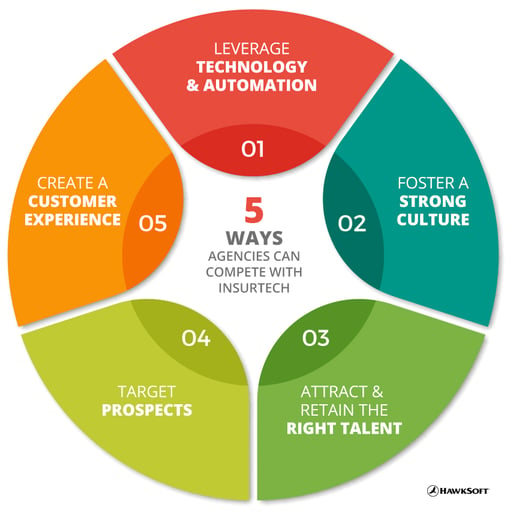

5 ways agencies can compete with Insurtech

There are 5 key things agencies can do to compete with—or differentiate themselves from—their Insurtech competitors.

1. Leverage technology and automation

Technology is one of the main areas where Insurtech startups outpace agencies. These digitally native companies rely on technology like automation, artificial insurance, and cloud computing to win customers over to their new way of doing business. They leverage customer usage data, provide personalized experiences, and enhance transparency.

Independent agencies might not have the same access to cutting-edge technology, but they can maximize the digital tools they’re already using, like the agency management system. Your agency should be leveraging your system to automate time-consuming tasks so you have more time to focus on areas where Insurtech can’t compete, like building strong personal relationships with your clients.

Look into the features your agency management system offers to automate your workflows. Does it have the features listed below? Do you have them set up and optimized to your workflow?

Auto-documentation

Guarantee that every interaction between insured and agent is tracked with log notes that are automatically generated when actions are performed.

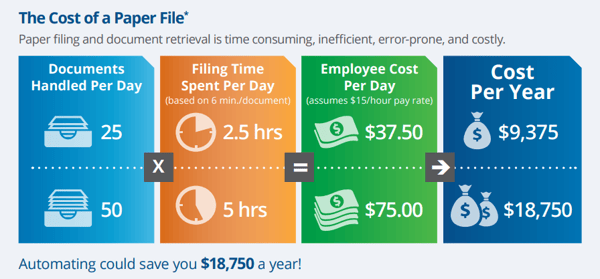

Paperless features

Store all client touchpoints digitally in one system with digital documentation, e-signature capabilities, and virtual printing.

*Assumptions: Average filing time per document is 6 minutes; employee pay is $15/hr; 250 working days/yr

*Assumptions: Average filing time per document is 6 minutes; employee pay is $15/hr; 250 working days/yr

Source: Price Waterhouse study | Designed by HawkSoft

Form auto-population

Eliminate manual entry and errors by flooding info from carrier downloads into ACORD Forms.

Batch emailing

Ensure that communication is both automated and personalized with segment targeting, email templates, and merge fields for policy data.

Mobile features

Communicate with clients on the devices they carry with them through client texting and an insured app.

Aside from the management system, there are many other digital tools agencies can employ to find leads, communicate with clients, and make traditionally cumbersome processes more efficient for both sides. Just remember that the purpose of digital tools should be to enhance the personal relationship with the client, not replace it.

Your agency should be leveraging your management system to automate time-consuming tasks so you have more time to focus on areas where Insurtech can’t compete, like building strong client relationships.

2. Foster a Strong Culture

Tech companies are attracting millennials by offering a seemingly endless list of perks and benefits, and Insurtech startups are no different. But free 5-star meals and shiatsu massages aren’t the only way to attract young, digitally savvy talent. At its core, startup culture is about creating a workplace environment that values creative problem solving, open communication, and a flat hierarchy. According to a Carrier Management article on Insurtech culture, “nearly all the InsurTech executives spoke of cultures where 'everyone has a voice' and where information is shared. Likewise, only LaRocco and several InsurTech executives mentioned having 'fun' as an aspect of culture.”

In startup cultures, the core values reflect the personalities and ethos of the people who started the business. Openness, business agility, and adaptability are key virtues. Fortunately, independent agencies inherently foster this type of environment.

See how HawkSoft's company culture has landed awards for 5 years straight

You can adopt the culture of a digital agency by focusing on fostering a fun environment where everyone feels as if their contributions affect the direction of the organization. Ultimately, you want your team to be excited and proud to show up every day. This means finding creative ways to attract the best and brightest and improve team morale across the agency.

3. Attract and retain the right talent

The digital age will require a new breed of agents with different and evolving skillsets.

Because many of the biggest Insurtechs are positioned in New York and Silicon Valley, they have access to large and diverse talent pools. Insurtechs have focused on hiring the best and brightest who are skilled in all things technology. They aren’t hiring sales and customer service people, but rather assembling a team of developers and marketers to create an online customer experience.

Agencies looking to compete in the digital space will need to hire digitally talented people. Some of the raw skills to look for include social media management, digital marketing, copywriting, brand-building, and PR. While Insurtech focuses on technical skillsets, you should look for digitally-savvy people people. Those in your agency without digital skills can learn new ways to apply their expertise. A master networker, for example, can focus on building online communities.

Furthermore, to become a digital insurance agency, your hiring process should be digital as well. You can attract prospects through online job postings and social media sites, initiate the hiring process with video interviewing systems, and streamline onboarding with video training tools.

4. Target prospects

The sales and marketing battleground has shifted to digital arenas. 74% of shoppers use insurer websites or aggregators for obtaining quotes and researching information (J.D. Power).

The Insurtech model for attracting new prospects is to take their venture funding and apportion it toward performance advertising and PR marketing on a national scale. They use performance ads, PPC, and social media ads to target their demographic and acquire customers for much less than industry standard.

Independent agencies can combat this by geo-fencing their online boundaries to focus solely on their local area. By combining local and regional PPC campaigns with local search engine optimization, prospects in your territories searching for insurance will find you first.

Independent agencies can combat this by geo-fencing their online boundaries to focus solely on their local area. By combining local and regional PPC campaigns with local search engine optimization, prospects in your territories searching for insurance will find you first.

The broad focus of Insurtech means they can’t compete with you online on a local level. Since they don’t have a local presence, they don’t have online listings like Google My Business. This means two things. First, they don’t have as good of a chance to appear for local search terms (e.g. insurance Los Angeles) as you do. Second, they aren’t as prevalent on mobile search because local searches from mobile devices see mobile Google My Business listings with the coveted click-to-call feature first!

5. Create a customer experience

To Insurtechs, customer service is a reactive strategy. Instead they focus on customer experience. They have a tailored sales funnel designed to be easy to use and increase engagement from awareness to referral. They go the extra mile to build an experience around being their customer. McKinsey gives an example of this: “another Insurtech, Bought By Many, demonstrated highly personalized experiences in pet insurance, including gifts on pets’ birthdays and personalized letters in response to claims.”

They’ve created a personalized and tailored experience based on customer data, and used segmented campaigns to deliver the right message at the right time. They’ve identified ways to offer more than just insurance and cultivate an online following.

The independent agent’s advantage in transforming to become a digital insurance agency is the human advantage. By using digital tools to provide a human touch, you’ll offer an experience that the Insurtechs can’t match.

While your agency doesn’t need to invest hundreds of thousands into hiring a web development and programming team, you should focus on what can be repeated. Local agencies have an advantage in the fact that they can not only utilize digital tools, but they can focus on the things that don’t scale.

For example, Partee Insurance gives this list of benefits that only independent agents can offer:

- More choice in policies

- Expert, unbiased advice

- A long-term client relationship

- Participation in the community

- Help throughout the entire claims process

The independent agent’s advantage in transforming to become a digital insurance agency is the human advantage. As the world shifts digitally, what are some of the ways your agency can delight your customers in a systematic manner? Do you send email newsletters about your involvement in the community? Do you highlight your clients on social media? By using digital tools to provide a human touch, you’ll offer an experience that the Insurtechs can’t match.

Achieving success in a digital world

The agencies that will be competitive in this new digital marketplace are those that rapidly embrace technology and use it to enhance their true strength: client relationships. By leveraging technology and automation to foster a strong culture, attract the right talent, target prospects, and create a unique customer experience, your agency can differentiate itself from the competition.

|

Want to learn how becoming a digital agency can help your organization reach its growth goals? Infinity Leads will create your custom digital marketing plan so you can attract your ideal prospects on autopilot. |