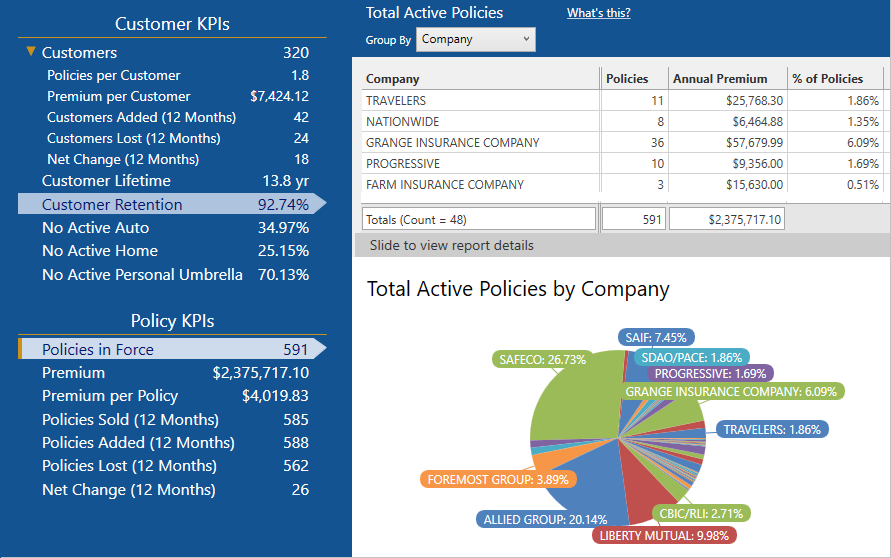

Image source: InsuredMine

Guest blog by Scott Taylor, InsuredMine

Guest blogs are written by contributors outside of HawkSoft. The author's views are entirely their own and may not reflect the views of HawkSoft.

It has been said, “A person who cannot sell an idea is no better than a person who does not have an idea.” No matter how great your products are, they are worthless if you don’t have someone who can convincingly explain what the value is behind your expertise.

There are two main types of approaches that businesses take with sales: one is consultative and service-oriented, focusing on solving the customer’s need above all else; the other cares only about separating the customer from his or her dollar. While the second approach may employ scams, hustles, and manipulation tactics that work short-term, a consultative approach based in trust is the only way to build a sustainable business model that supports retention and feeds referrals.

Many insurance salespeople use a product centered approach, which can cause frustration, confusion, and lack of proper communication, especially with a product that is so technical and intangible. The consultative approach makes communication more comfortable for the customer by meeting them on their terms, which will ultimately win more deals and build greater retention.

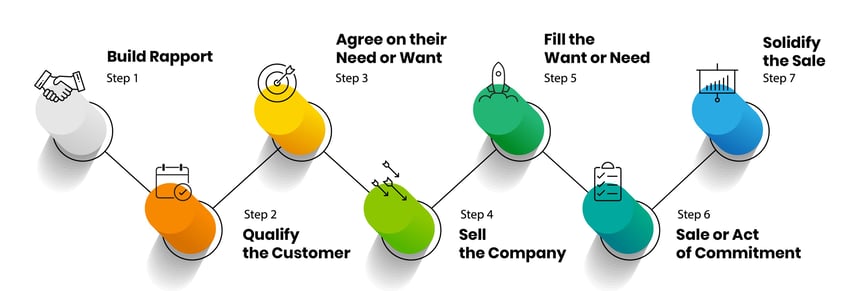

So how do you build a sales process that feels consultative to the customer and assures them that your main goal is to help them rather than simply to make the sale? We recommend this 7-step strategy, bearing in mind the consultative steps to professional sales.

- Build Rapport

- Qualify the Customer

- Agree on Need or Want

- Sell the Company

- Fill the Need or Want

- Sale or Act of Commitment

- Solidify the Sale

The stages of this strategy can be customized for your agency, and some steps may overlap or occur simultaneously. For instance, the Build Rapport and Qualify the Customer steps may be one stage in some agencies, or the Build Rapport step might apply throughout all steps of the process.

1. Build rapport

Building rapport (a strong relationship with a prospect) is one of the most important steps to any sales approach because people buy from salespeople they trust and without rapport, there is little trust.

The best way to establish rapport is to show that you genuinely care about and are interested in them, not yourself or your wares. You do it by giving short little comments regarding what they are talking about. You show you are listening intently and with interest. You do this by saying simple things like: wow; really; how did you do that; that’s amazing; you must have really felt good about that; that’s impressive; have you had any other ideas like that?

Showing interest with emotional responses coupled with questions showing you are intrigued with their story sets you apart by establishing that you want what is best for them more than you want to make a sale.

2. Qualify the customer

Fact-finding and feeling-finding questions

Qualifying the customer is the next most important step in your sales strategy. Obviously, two of the qualifying answers you need are that they have the money, and they are the decision-maker. Outside of that, you need to establish their need or want. In doing this you need to ask open-ended questions that are fact-finding and feeling-finding. Fact-finding questions give you the required information needed for the application, such as birth date, smoking, car model, age of the house, pre-existing conditions, etc. Feeling-finding questions give you the required information to make the sale, such as how is this problem affecting you? Would this be exciting to you? How would this help your situation?

The 9 buying emotions

As you work to ascertain their need or want, it’s helpful to be aware of the nine major buying emotions that influence all purchases. You have never parted with money without experiencing one of these emotions prior to spending the money, even as a child asking for a 25-cent candy. The buying emotions include the following:

- Desire for financial gain

- Fear of financial loss

- Convenience

- Satisfaction of an emotion (love, hate, envy, greed, etc.)

- Safety

- Security

- Obligation

- Pride of owning the biggest, best, etc.

- Comfort

If you are not mindful of these emotions (often thought of as the “hot buttons” in sales) and looking for them while selling, you may be selling the wrong product for the wrong reason. Most people tend to hide their emotions in a sales situation, so it may take some digging to find the underlying emotion driving their purchase. In insurance the most common buying emotions you’ll encounter are likely fear of loss, safety, and security, but the desire to purchase insurance could be driven by any of the nine.

Image source: InsuredMine

3. Agree on need

Agreeing on need is a very simple step, yet the lack of it could be catastrophic to your presentation. It is simply recounting to the person, in different words, what you believe they are looking for. After finding out all the information you need about their problems, needs, and wants you ask something like, “So, the way I understand it, you are looking for coverage that will protect your family but also pay your expenses should you end up hospitalized, is that correct?” They will then tell you if you misunderstood them or if you have their needs in the proper perspective. This step helps sell the package because when they are given a chance to spell it out to you again, they feel more confident that you do understand what they want.

4. Sell the company

This doesn’t mean to literally sell your business. When we get to the buying decisions, you will find that the second most important buying decision, aside from the product, is the company or who backs up everything the salesperson is saying. Hence, we need to let our customers know that your agency is strong and has staying power, especially in a time when even the mammoth corporations we believed would be here forever are starting to fall. This doesn’t mean you have to give a long dissertation regarding the company. You can simply share some examples of how the company has made decisions backed by principles and practices that are forward-facing and centered on the customer.

5. Fill the need

The temptation to fill the need usually begins in the qualification step, but that is the wrong place to begin. This is the step where you give your presentation and sell. If you start selling before the customer feels you understand them or their needs, or if there is some fear they have about dealing with your company, then your presentation will fall on deaf ears. Once you have all the information you need to give a good presentation, with only those features and benefits they need or want, then you proceed to sell them. In the meantime, you can continue to work this deal on the sales pipeline in your insurance CRM and agency management system.

6. Sale or act of commitment

Getting the sale is the primary object of being on a sales call. It has been estimated that over 50% of all missed sales opportunities happen because the salesperson was afraid to ask for the business. Once you have given them the features and benefits of your products or services it is time to ask them to do business.

There are those situations where you may need multiple visits prior to getting a contract. In those situations, you will ask for an act of commitment. Let’s say they don’t have all the information you need to write a policy. You will ask how long it will take to get the information, then ask for another meeting after that time. Optionally, you could ask for the sales contingent upon receiving the following information. The challenge in this situation is you are never managing one deal or 5 or 10, but many more, so it is of paramount importance to have a system in place that will allow you to not only track them but to work through the list in a smart and effective way. Sales automation tools are specifically designed to manage such workflow with events and date triggers for tasks, reminders, follow-ups via email, text, phone, voicemail, etc.

On when to stop talkingMark Twain recounted this experience that offers some sagacious advice to salespeople on knowing when to shut up a make the sale: "He was the most eloquent orator I ever listened to. He painted the benighted condition of the heathen so clearly that my deepest passion was aroused. I resolved to break a lifelong habit and contribute a dollar to teach the gospel to my benighted brethren. As the speaker proceeded, I decided to make it five dollars, and then ten. Finally, I knew it to be my duty to give to the cause all the cash I had with me—twenty dollars.” “The pleading of the orator wrought upon me still further and I decided not only to give all the cash I had with me but to borrow twenty dollars from my friend who sat at my side. That was the time to take up the collection. However, the speaker proceeded, and I finally dropped to sleep. When the usher awoke me with the collection plate, I did not only refuse to contribute, but I am ashamed to state that I actually stole fifteen cents.” |

7. Solidify the sale

This step has one particular goal and that is to remove buyer’s remorse. The three-day right to rescind any contract was enacted because of this very problem. Hustlers and scam artists would do or say anything to bilk unsuspecting souls out of their money and by the time the victim finds out that the salesperson lied, there is nothing they can do about it. With plenty of businesses out there that don’t care about a customer once they’ve taken their money, people want to be assured that they won’t be forgotten after they sign on the dotted line.

Solidifying the sale helps allay fears after they sign the contract. In this step you recount what you are going to do and assure them they made the right decision. You give them the comforting statements they need so they will feel they made the right decision.

Implement a successful sales process

While these are the 7 overarching steps in a consultative sales process, you may want to tweak or customize them for your agency; you may even want to have multiple strategies for multiple product lines. Having a CRM to help you through the stages of your sales strategy is paramount to the successful conclusion of a well-planned strategy.

No matter what your sales process looks like, focusing on the customer’s needs rather than your agency’s will make all the difference in finding quality leads and turning them into satisfied customers.

Automate your sales processTrack, automate engagement, and analyze data throughout the sales process with InsuredMine. |