May 20 - 21, 2019

Cincinnati, OH

This meeting focused heavily on the growing presence of APIs, the opportunities available through data analysis, and industry collaboration.

APIs and Insurance

Nearly half of the sessions presented over the two-day meeting touched on or had a specific focus on APIs (Application Programming Interfaces). HawkSoft published its thoughts on how we plan to engage APIs here. DAIS, an Insurtech company focused on improving workplace efficiencies, presented a full session on the ins and outs of APIs. They even had a quick video to cover the basics that is well worth a watch. While presenting, Jason Kolb of DAIS summarized an API as “a messenger that takes your request and takes it to a system for you.” Vendors and insurance companies have used APIs internally for years, but are now starting to expose them to outside partners. New Insurtechs, like DAIS, are entering the marketplace with APIs as one of the cornerstones of their strategic vision.

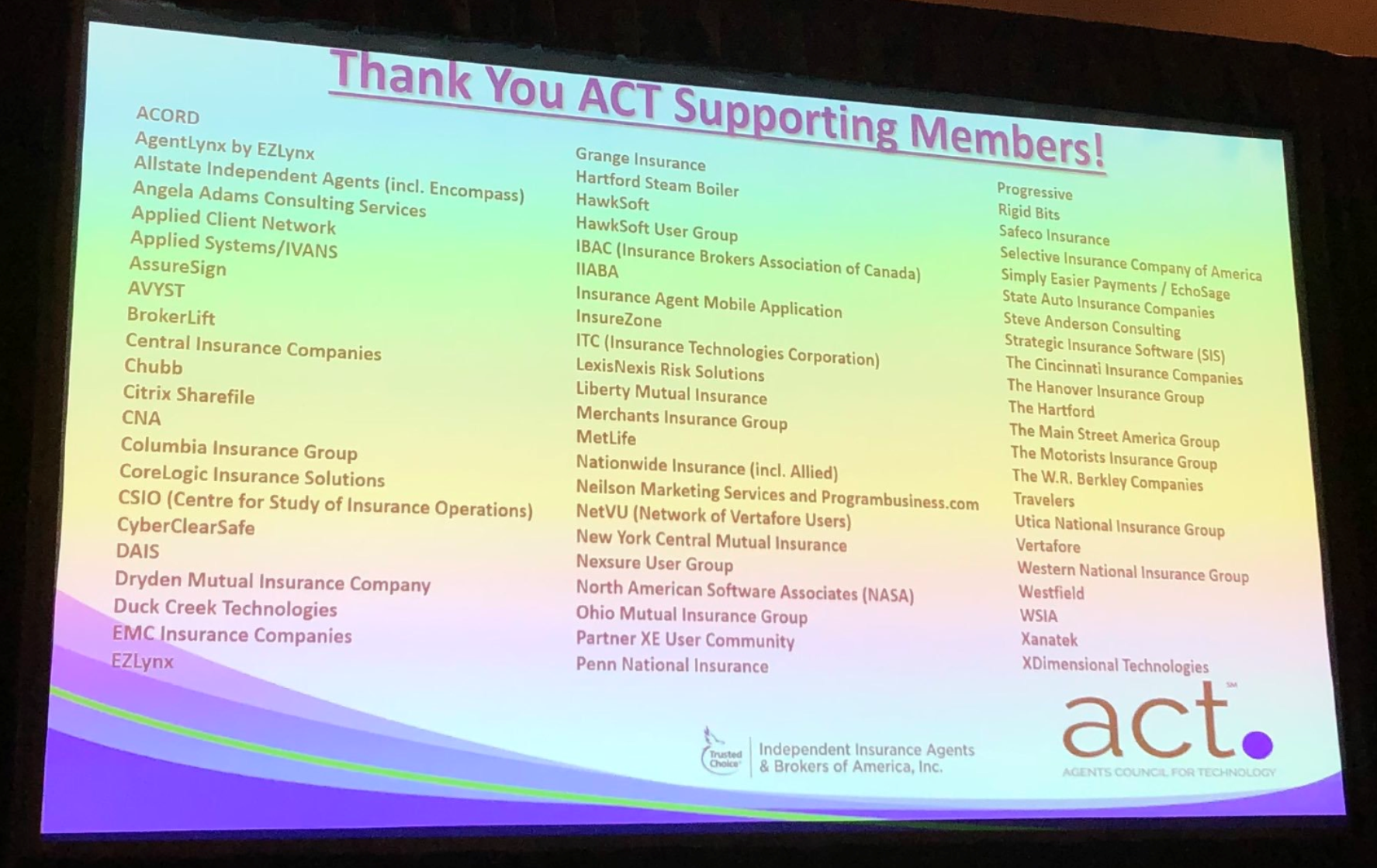

ACT has a workgroup of vendors, agents, and company representatives meeting frequently to discuss APIs and how to better embrace them industry wide. Workgroup chairs at this meeting led a discussion on how to unify and push forward. A primary concern raised was trust. APIs can connect vendors to companies, companies to agencies, and companies to the insured.

Who owns the data traveling to and from APIs

has some agents worried.

HawkSoft’s Kenneth Hendricks urged everyone to pay close attention to security and the trustworthiness of integration partners. Ask about and document how data will be shared and used, and understand the risks involved with sending data outside of their own systems. There is an understandable fear held by some agents with specific regard to sending an insured’s contact information to an insurance company via an API (or through an app). Navigating the future of APIs will require navigating the relationships and trust between all parties.

Data is king

One of the most interesting presentations came from Jeff Smith of the Ohio Insurance Agents’ Association (OIA). Jeff was filling in for a colleague and walked the audience through IntellAgent, a data analytic tool developed by OIA. Many new agencies (or even established outfits) struggle to understand how well they’re doing compared to their peers or the market average. IntellAgent, and its R.I.S.E report, solves that. IntellAgent aggregates data and KPIs provided by OIA member organizations into statewide benchmarks, giving insight into questions like these:

- How does your premium level compare to the state average?

- How about retention?

- What is your employee age allocation?

- Is your overall agency health good enough to attract new talent?

- How does your compensation structure compare to others?

- Which carriers do you perform well with? Which underperform for you?

IntellAgent shared an interesting observation about the Ohio insurance market. Of the $14.75 billion in annual premiums collected by Ohio agencies, $6.49 billion is held by an agency with a principal over the age of 55. That is 44% of the total annual premiums in Ohio. By their estimation, this same situation is playing out across the country. It might not be a surprise to insurance professionals that many of their peers are reaching retirement age, but seeing the actual numbers clarifies how critical of a moment the industry is at. With the facts in hand, a principal can evaluate whether there is a better ROI in spending money on advertising/marketing for new customers or in purchasing the book of business from a retiring agent.

Sharing data via APIs and integrations will break down the silos that information has traditionally been quarantined into. Business intelligence and analytics tools, like IntellAgent, will help guide principals towards the best decisions.

Collaboration: a rising tide lifts all boats

Paul Hawkins often notes that at ACT meetings, “we all take off our company hats.” That is to say, everyone who participates with ACT does so in the spirit of good faith. HawkSoft may compete with some fellow vendors in attendance, but for those two days in Cincinnati we were colleagues. HawkSoft’s mission is to push the independent agency channel forward. ACT and its members believe in the same cause. Insurtech, once a feared horseman of an independent agent apocalypse, is greeted with open arms. The traditional vendors, after all, were Insurtech before a time when the term existed. Independent agencies can and will continue to thrive. The most direct route to that is through strong collaboration among agents, vendors, and insurance companies.

Resources for 2019 ACT Meeting

You can find the 2019 May ACT Meeting materials here. If you are an independent agent, a technology vendor who serves them, or an insurance company, HawkSoft encourages you to join ACT. Learn more on their website.