Image source: shutterstock

Farming is one of the world’s oldest professions, and it’s still going strong today. According to US Department of Agriculture census data, there are over 2 million farms in the United States, 97% of which are family owned. Just as farming technology has changed over the years, the associated insurance needs have evolved as well. If your agency sells farm or ranch insurance, it’s important to understand the risks associated with farming and the types of coverage available. This article will help you understand your farm owners’ needs and the best ways to protect their risk exposure in the business of farming.

- Overview of what’s at risk for farmers

- Property Coverage (buildings, crops, livestock, machinery, and more)

- Liability Coverage (horses, land use, and pollution)

- Interview with farm insurance expert Jeff Joseph of Farm & Country Insurance.

- What to focus on when writing farm/ranch policies

- Why the Farm Module in HawkSoft excels over other vendors (in Jeff's own words)

What’s at risk for farmers

![]()

Insurance coverage for family farms is far more comprehensive than a homeowner’s policy. It involves understanding the different types of risks beyond the dwelling and basic farm equipment. Additional buildings, livestock, crops, specialized equipment, and pollution exposures have to be accounted for and insured accordingly. Liability exposure plays a role if people are employed to harvest crops or consumers visit the farm to “pick-your-own” or buy directly. For most farms or ranches, the most cost effective and efficient way to obtain property and liability coverage is with a package policy that combines a variety of coverages in a single contract, similar to a Businessowner’s Policy (BOP), but customized to a farm or a ranch.

A farm/ranch policy is essentially a combination of a homeowner’s and commercial general liability policy, providing coverage for the following and more.

Property Coverage

Buildings

Various structures—such as the family home, the barns for the farm animals, the feed barn, the buildings that hold the equipment, crop storage units, and the workshop for repair or service—must be listed on the policy to be covered. “If the structure is not listed on the policy, and it is not used as an appurtenant structure to the main home by policy definition, then the structure is not covered” (Insurance Journal).

Crops

The Federal Crop Insurance Corporation (FCIC) is a wholly owned government corporation that manages the federal crop insurance program. Farm policies do not cover crops while they are growing, so farmers should consider adding crop insurance to protect crops before they are harvested. It covers current planting and the inevitability of weather conditions such as tornadoes, hail, flood, or drought. Crop insurance also protects you from loss incurred due to market price fluctuations. Consider insurance options like:

- Multi-peril crop insurance: Covers inescapable crop loss, crop yield decrease, market price fluctuations.

- Crop-hail insurance: Covers hail, freeze, windstorm, transit, storage.

- Specialized peril: Covers grain fire, rainfall, citrus freeze, hay fire, etc.

While crop insurance covers some business operations risk, farmers should also consider additional business insurance, such as:

- Loss of business income coverage: Protection for business interruption, replacement of lost income, and providing operating expenses (available on most farm owner policies).

- Workers' compensation coverage: Protection for workers and employees from sickness, injury, or job-related accidents. IMPORTANT: Each state has its own guidelines and requirements. Check your state’s Department of Insurance for details on your state’s requirements, and then communicate this to your customer.

- Commercial vehicle coverage: Protection for transport trucks and trailers used for business.

Livestock

Depending on the types of animals on your farm, special coverage for cows, horses, goats, chickens, and other animals found on family farms or ranches may be required. Some options to consider include individual coverage and blanket coverage.

- Individual coverage (scheduled): Schedules higher-valued animals, such as special beef cattle or a race horse, individually so they can be covered to a specific dollar amount.

- Blanket coverage (unscheduled): Insures all of the farm property (livestock and equipment) in one lump sum amount. When using blanket insurance, make sure to insure to the appropriate actual cash value (ACV), because being under-insured could result in a co-insurance penalty.

Inventory

Harvested crop inventory includes fresh foods and processed or value-added products such as bottled milk, cheese, meat, jam, cider, wine, etc.

Machinery / Equipment

It’s important to note that farm property contents are not automatically insured under farm and ranch policies. You need to purchase additional insurance to cover machinery and equipment. This includes tractors, harvesting equipment, and other tools needed to plant, harvest, and maintain crops. For example, gardening tools in a tool shed are automatically covered under a homeowner’s policy. But a farm policy does not cover a $50,000 harvester unless it is specifically scheduled.

Fencing

Fencing is not usually covered in a farm or ranch policy. Although most owners decide not to insure standard fencing, there are coverage options available if so desired.

Liability Coverage

Horses

Horses may require state-specific equine liability signs "warning horses are inherently dangerous, and that a visitor is not a spectator but a participant assuming risk" (Insurance Journal). Insurance companies also require an equine liability release waiver to be signed by anyone riding or boarding horses on the property.

If other people’s horses are boarded at the location, the stable is considered a commercial building and is no longer covered under a homeowner’s policy. There are two insurance options that can be used in such situations:

- Use a monoline equine commercial general liability policy, with an annual premium of about $1,000.

- Change the homeowner’s policy to a farm policy, where the home and personal property are both covered by the policy. If there is a stable or additional activities, additional coverage may still be needed.

Land Use

Land use insurance includes coverage for the primary operation, employer liability, roadside stands, and “pick-your-own” activities such as berry picking. It helps protect you if someone else has had an accident on your property and files a bodily injury claim.

Pollution

“Environmental impairment loss exposures are inherent in the operation of a farm, and these loss exposures cannot be avoided in the business of farming” (IRMI). Lawsuits for pollution-related loss exposures are increasing, especially from drinking water supply contamination and odors. Unfortunately, many of the farm package insurance programs sold to farmers lack sufficient coverage for claims resulting from gradual contamination of water, soil, or even odors. IRMI’s article Insuring Farmers for Environmental Damage Claims provides a good reference list of common environmental loss exposures associated with farming:

- Surface water contamination

- Crop overspray (insured under average farm package policy)

- Odors

- Reduction of neighboring property values

- Public nuisance

- Trespass

- Operating or participating in manure digesters

- Damage to natural resources

- Bodily injury from exposure to bacteria

- Groundwater contamination and remediation

- Fuel storage tanks

- Fertilizer spills/releases

- Custom farming operations

- Transportation risks (e.g., manure hauling)

- Storage and application of pesticides and herbicides

Jump ahead to see why agent Jeff Joseph deems pollution one of the most important things an agent needs to be mindful of when writing farm insurance.

Umbrella Liability Insurance

Insurance policies, including farm policies, only provide coverage up to the maximum limits of the policy. Many policies also contain exclusions, exposing insureds to additional risks and creating gaps in coverage. With the inherent financial risks involved with farming and ranching, agents should discuss in detail the benefits of umbrella liability insurance and how it can provide additional liability insurance for incidents or legal expenses not covered by a standard policy.

Interview with farm insurance specialist Jeff Joseph

Jeff Joseph, farm insurance specialist of Farm & Country Insurance in Honeoye Falls, NY, has been focused on insuring farms since 1999. Serving over 600 New York state farms, including dairies, livestock, fruit and vegetable growers, equine, goats, alpacas and more, they are the go-to agency in upper New York for farm insurance products. Jeff uses the HawkSoft agency management system to write small and large farms alike, making sure every unique customer has proper, comprehensive coverage.

Years of in-depth study of farm policies, including reviewing competitors’ policies, have helped Jeff’s team discover how policies can be exploited and how gaps in coverage can unintentionally expose the farmer to potential risks.

His involvement with various industry groups that support farms has helped build his brand over the years. By attending trade shows, speaking to, and being actively involved with these groups, his agency is now recognized as an industry expert, garnering respect from many farm owners and carriers alike.

We talked with Jeff to better understand the farm/ranch niche market and what it takes to be a respected farm insurance specialist. He provided valuable insight to the following questions:

- What should agents be mindful of when writing farm policies?

- What could the industry do to better support farm policies?

- How does HawkSoft’s management system support your writing of farm policies?

- What should owners look for when choosing an agent to write their farm insurance?

- What have you gained, that has influenced your career, as a result of writing farm policies?

1. What should agents be mindful of when writing farm insurance?

Jeff Joseph (JJ): Writing farms is not something every agent can do well. It takes focus and attention to detail. We pursue farms—it’s our niche market. This allows our agents to be immersed daily in the risks of writing farm policies, which leads to a high-level of knowledge.

“To do this niche market right, you cannot be a generalist, writing restaurants one day and grocery stores the next. For us, every day is farms. Unfortunately, farm owners who use an inexperienced agent will often have gaps in coverage.”

- Jeff Joseph

Farm & Country Insurance

3 important things agents need to be mindful of:

1. Proper pollution coverageI can’t emphasize this enough. It is critical to make sure the policy covers various pollutions and accidents/spills, including chemical spills.

Pollution is a huge issue, not only in upstate New York, but throughout the country. New York has a lot of fresh waterways and streams that lead to beautiful lakes. Combine that with a lot of manure that’s spread and the occasional big rain storm that comes up, and you create a risk for contamination and/or a spill. Knowing exactly how your policy covers pollution is very important for auto, business liability, and umbrella coverage. Also, it’s good to know how much, if anything, the policy will pay for chemical spill cleanup and testing, which can get very expensive.

2. Umbrella coverage

Umbrella coverage is very important for farms. As a farm gets larger, the more trucks they acquire and have out on the road, causing more accidents and spills. When I talk to my carriers throughout the nation, it’s almost always an auto claim that gets into the umbrella.

The challenge is trying to convince larger operations that a million dollars of liability is not enough anymore. Sometimes you have to push to get them to buy more.

3. Knowing the details

One thing I’ve learned is that there can be hundreds of details on a farm policy that need to be reviewed. It’s not easy to have that detail-oriented brain and also be able to sell something. It takes the right type of person to really understand this niche market and to be able to understand the details. Do you have every auto and piece of equipment accounted for—are those 15 houses, 38 barns, and 63 vehicles covered? Do you have the cabbage insured properly, the seed, grain, and fertilizer? The list goes on and on.

Not every agent knows how to dive into the details to write insurance that will properly protect the farmer. You must be prepared to do this, using a checklist to ensure nothing is missed, along with a good management system that can help.

2. What could the industry do to better support farm policies?

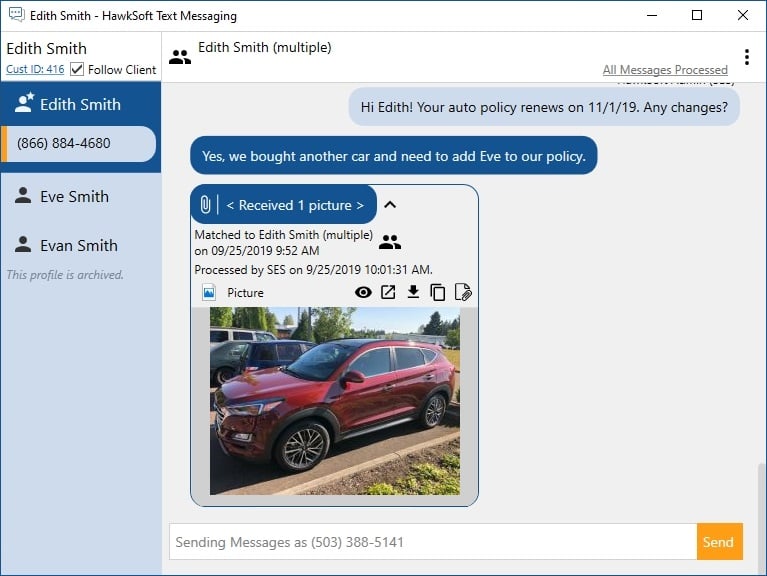

JJ: Download! None of our farm carriers download, and I write with some of the biggest farm carriers in the nation.

When you look at the enormous amount of detail involved in this business, combined with no download, you end up with a lot of manual entry. This is another reason to have a very good agency management system to help track all the detail.

3. How does HawkSoft’s management system support your writing of farm policies?

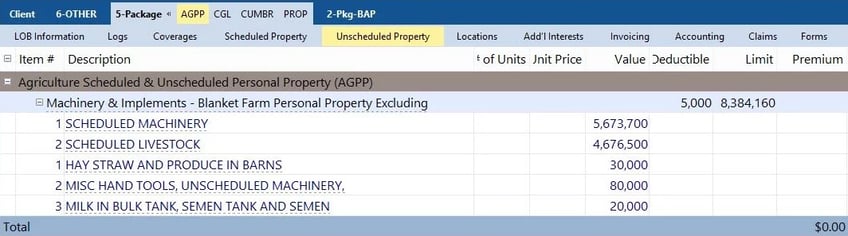

JJ: When we learned that InStar was going to be sunset by AMS, we spent over a year looking at the larger management systems. We found that they all do 90% of the same thing. Our differentiator was who could handle farms the best. HawkSoft’s Farm Module won us over. Almost nobody has a farm module.

Two areas where HawkSoft’s Farm Module stands out are:

- Machinery list: HawkSoft can create a machinery list that can be changed throughout the year. Other systems create an additional list instead of changing the existing list.

Example: If I made 30 changes to a policy in one year, which is not unlikely with some of our bigger farms, I would have 30 different lists in the records for that year. I don’t want that because we have our farm customers for many years and I don’t want hundreds of lists to archive. HawkSoft keeps it simple by allowing you to change an existing list. - Blanket list: HawkSoft creates a comprehensive, accurate list of grouped properties. As the agent, we are responsible for keeping the blanket lists; the insurance carrier does not keep that list...just the limit. Since we’re the ones keeping the list, this feature is important to us.

Example of HawkSoft's Farm Module: Blanket Inventory Schedule Summary

Click here to see how HawkSoft creates a Detailed Summary

of scheduled and unscheduled property.

HawkSoft’s Farm Module tools and its competitive price are the two primary reasons we remain on HawkSoft. We also love our customizable ID Hot Button that lets us generate an ID Card within 60 seconds! We easily do 800–1,000 vehicle changes a year, so being able to do these lickity split is huge.

“Thank you to HawkSoft for caring about farms, because other big systems that we looked at did not seem to have a focus on servicing farms. HawkSoft helps us write comprehensive farm policies and bridges the gaps that exist in other systems.”

- Jeff Joseph

Farm & Country Insurance

4. What should owners look for when choosing an agent to write their farm insurance?

JJ: Many business owners don’t know about insurance and they rely on the agent to be competent and take care of their insurance risk. We’ve seen a lot of policies that are not written properly, exposing significant risk to the insured.

Farm owners should find an agent who:

- Is competent. They should dive into the details and ask those nitty-gritty questions. An agent should be willing to walk the property and learn how the farm operates. Intimately knowing the inventory is the best way to know what should be included in the coverage.

- Schedules an annual review. An agent should always offer to do an annual review, even if the insured turns it down. I can’t tell you how many times a farm bought a $250,000 piece of equipment and forgot to tell us about it. Or, they built a new barn. You go out to the farm and there is a building on it that wasn't there the year before. I tell someone, “If your agent doesn’t offer to review your policy annually, your agent isn’t going to bat for you. You need a new agent.”

- Discusses pollution. Make sure you know how you are covered for chemical spills. Discuss things such as over-spray limits and defense limits. I’ve seen some pollution lawsuits where the defense alone is over $1M. If you have $50,000 in pollution coverage and defense is within that limit, you could find yourself in a bad situation pretty quickly.

- Discusses coinsurance penalties, ITV, and ACV. Agents should have conversations with you about coinsurance penalties and know how to adequately calculate insurance-to-value (ITV) or actual cash value (ACV).

“So often the client does not really know the total value of their farm ownership or what should be insured; they only have a rough guesstimate. If they took the time to add up all of their inventory it would blow their rough guess away with a much higher replacement figure that’s based on reality. An experienced agent can accurately calculate their ITV or ACV.”– Richard Garrick

HawkSoft Product Support Specialist and former insurance agent

5. What have you gained, that has influenced your career, as a result of writing farm policies?

JJ: Company relationships. When you’re in a niche business like this, you write with only a handful of carriers, creating very substantial, long-term books with a couple of excellent companies. The benefit of this is you end up being one of the larger agents, which gets you a seat at the table. Mutual respect and trust is built, resulting in easier underwriting.