Image source: Shutterstock

Guest blog by Craig Niess, IntellAgents

Guest blogs are written by contributors outside of HawkSoft. The author's views are entirely their own and may not reflect the views of HawkSoft.

Many independent agency owners believe that agency valuation is only something they need to think about when planning to sell or perpetuate their agency. However, understanding agency value can benefit any agency by driving behaviors that increase the value of what is likely your largest asset. Understanding your agency’s strengths and risks will help you make key decisions about its future, whether retirement is on the horizon or you’re looking to grow your business.

This article at a glace:

- Why get an agency valuation?

- How is agency value calculated?

- What factors affect agency value?

- Ways to get your agency valuation figures

Why get an agency valuation?

The main reasons to get an agency valuation done are for business planning, impending retirement, and perpetuation planning.

Business planning

Many agency owners have never had a valuation and are naturally curious about what their agency is worth. Agencies are valued based on how profitable they are currently, and how likely they are to remain profitable in the future. A valuation conducted by professionals who specialize in independent agencies is a good way to truly understand the agency’s value and which factors will increase or decrease this value over time. Knowing the right levers to move can help agencies drive profitable growth and increase value.

In addition to a valuation, best-in-class agencies utilize benchmark reporting to show how they compare to their peers. IntellAgents offers a R.I.S.E. (Relevant Insights for Strategic Execution) benchmarking report that shows how you compare to your peers in a variety of financial and operational perspectives such as carrier mix, employee salary and benefits packages, and more.

"Even though your agency is likely the largest asset you own, most owners spend little if any time understanding what their agency is worth and how to increase its value. You probably spend most of your day identifying areas of risk that your clients should consider addressing. Why not do the same for your business?"

- Brady Financial Group, Agency Equity

Internal perpetuation planning

For agencies that are planning on internal perpetuation in the future (transferring the agency to an internal employee or family member), a valuation every few years will ensure that you are on track to transfer the business in the manner and for the value that you had hoped. If you’re at the beginning of your perpetuation planning journey, a valuation will establish a baseline upon which all other decisions are made.

Knowing the value of your agency will help you establish the stock price for the shares you plan to sell or transfer, as well as decide on the price you would be willing to accept in an internal perpetuation versus a third-party sale.

Buying or selling an agency

Many agency owners are currently nearing retirement, and if they don’t have an internal perpetuation plan, their best options are usually a merger or a sale to a third party (another agency, bank, broker, or private equity firm).

Understanding what your agency is worth will aid you in your negotiations with acquirers. While other market factors might determine the actual price paid for your agency, having a baseline knowledge of your market worth will help alleviate surprises.

On the other side of the coin, agency valuation is also helpful if you are looking to acquire an agency. With the average age of an American insurance agent at 59 and 400,000 employees expected to retire from the industry within the next few years (McKinsey & Co., Bureau of Labor Statistics), a huge amount of business will likely be on the market in the near future. If you’re thinking about acquiring an agency, a valuation will help you assess the agency’s current health and potential for growth, as well as risk factors that might not be readily apparent.

How is agency value calculated?

There is a myth in the industry that value is simply a multiple of agency revenue. You will often hear an agency owner say, “I’m worth 1.5 or 2 times revenue.” But the reality is more complex and considers many factors. True agency value is calculated on the profitability of the business and projected future profitability while taking into account the inherent risk of the agency and its book of business. This requires more work to calculate than a guess based on a simple multiple, but it’s worth the effort to plan your agency’s future based on proven methodology rather than lore.

Value is more complex than simply a multiple of agency revenue. True agency value considers the current and projected future profitability of the business, as well as its inherent risks.

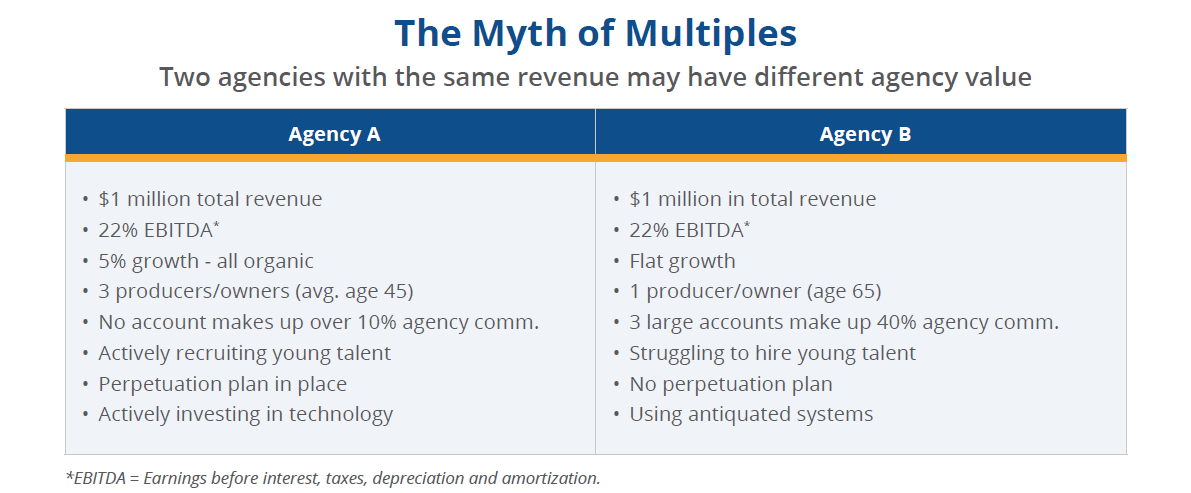

To illustrate the error in basing your value on a myth, let’s compare two different agencies. Each agency does $1mm in total revenue and each owner subscribes to the notion that they are worth 2x revenue, or $2mm. But when we compare these agencies, we see two very different stories.

Agency A has healthy organic growth, a diverse book of business and group of producers, a plan for perpetuation, and a commitment to investing in young talent and new technology. Agency B on the other hand has stagnant growth, a single producer nearing retirement who relies heavily on a few key accounts, a dependency on antiquated technology and systems, and no plan for the agency’s future.

This exercise exposes the flaws of the multiple myth. While both agencies have the same revenue and profit, Agency A is more marketable and certainly more valuable than Agency B.

A true fair market valuation is a deep dive into the financial performance of an agency and considers the risk profile of the agency. It includes three important steps:

- Examine data

An appraiser examines several years of financial statements, the book of business, key carriers, key accounts, and employee data. - Establish pro forma financials

Statements using assumptions about the future are established to determine the true profitability of the agency. To complete this exercise, normalizing adjustments are made to expense items such as owner compensation, overhead, producer pay, and selling expenses. These adjustments also remove non-recurring revenue and expense items. - Consider risk profile

A true multiple is established based on the risk profile of the agency. To arrive at the multiple, the appraiser considers a handful of risk factors and how they might impact the agency.

What factors affect agency value?

Here are a few factors that can increase agency risk and lower the multiple.

Narrowly-held stock

When only a few people or a single principal owns the majority of the stock and/or relationships in the agency, there is elevated risk for the business when the principal exits the agency.

Weighted average owner age

A single owner who is older and closer to exiting the agency creates more risk than a younger one or multiple owners, especially if there is no clear perpetuation plan for the agency.

Carrier concentration

Having too much of your book of business with a single carrier constitutes an increased risk of exposure if the carrier has a change in appetite, payment structure, etc.

Client concentration

If a few large accounts make up an overwhelming percentage of your agency’s total commissions and fees, risk increases. Value is greater when an agency has a more diverse mix of accounts so the business won’t be detrimentally affected if one client leaves.

Growth rate

An agency that has a steady growth rate and is focused on regularly bringing in new business has more value than one that relies solely on existing clients.

Generational health & technology

Agencies that don’t invest in hiring younger talent and keeping up with technology will not retain their value over time like those that do.

Ways to get your agency valuation figures

Now that you understand the importance of getting a true picture of your agency’s value, how do you go about getting a valuation? There are many professional consultative services that can perform a full valuation for your agency. If you’re looking to buy or sell an agency, or if you’ve never done a full valuation on your agency, this is the best way to get the most accurate and in-depth view of the agency’s value.

If you’re just looking for a quick ballpark estimate of your agency’s value, or benchmarking your agency’s progress between full valuations, there are online tools that can help. IntellAgents’ QuickClicks tools provide a fair market value range for an agency based on current market conditions, as well comparisons to key productivity metrics within the state and region.

Source: IntellAgents QuickClicks tool

Source: IntellAgents QuickClicks tool

A value-driven view

Understanding your agency’s value is critical to guiding its future, whether you’re planning for internal perpetuation, driving the value of your agency before you sell, or simply promoting your agency’s health and growth. Armed with an awareness of the factors that limit risk and increase value, you can be proactive about achieving your agency’s goals now and for generations to come.

|

Interested in an agency valuation with IntellAgents? |