The words “artificial intelligence” might bring to mind a futuristic scene where robots rule over society, but in fact artificial intelligence (AI) is already in play in our daily lives in smaller ways today, from virtual assistants that obey spoken commands to smart software powered by machine learning. AI tools have the power to automate processes, increase efficiency, and save time and cost for businesses as well—including your agency.

In this article we’ll explain exactly what AI is and what the most common types are, illustrate some of its most powerful implications in the insurance industry, and bust common myths about adopting AI.

This article at a glance

- What is AI?

- Artificial Intelligence

- Automation

- Machine Learning (ML)

- Natural Language Processing (NLP)

- Robotic Process Automation (RPA)

- Internet of Things (IoT)

- Applications in Insurance

- Underwriting

- Data entry

- Claims

- 24/7 customer service

- Lead acquisition & customer retention

- Myths about AI

- AI is too technical for me to understand or use

- AI will replace people or jobs

- I won’t know or have control over what an AI process is doing

- AI is a perfect and infallible solution

What is AI?

It can be confusing to understand exactly what AI means in a business context, especially when a number of terms tend to be conflated or used interchangeably. Let’s start by outlining the terminology, including the main types of AI and the most common terms you’ll hear in discussions around the topic.

Artificial Intelligence (AI)

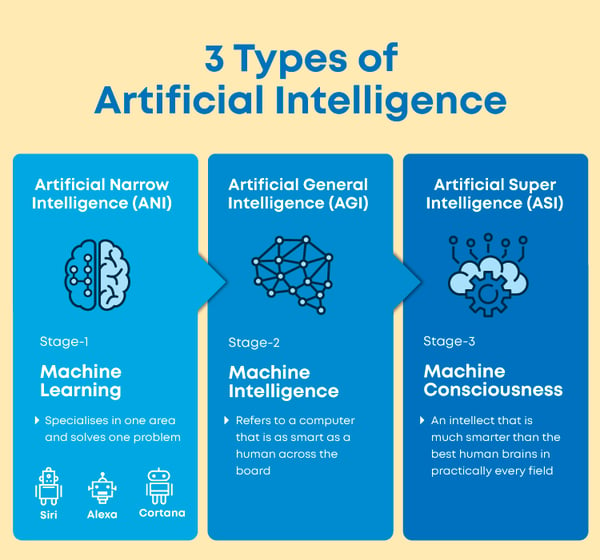

Artificial intelligence (AI) is a broad term encompassing any application that uses computers to complete tasks that traditionally require human intelligence or judgment. It’s usually broken down into 3 overarching categories: Narrow AI, General AI, and Super AI.

Narrow (or weak) AI is the type of AI that’s currently available for application today, and the type discussed in this article. This is technology capable of performing a specific task that requires human-level (or less than human-level) cognition. Narrow AI is programmed to operate in real time within a predefined range and using information from a specified data set. A good example of this would be virtual assistants like Siri, Alexa, or Google Assistant. While it might seem like these technologies are thinking for themselves when you ask them questions, in reality they are simply entering your requests or commands into search engines or applications and retrieving the results.

Narrow AI, the type of AI available for application today, is programmed to operate in real time within a predefined range and using information from a specified data set.

General (or strong) AI is technology capable of self-directed, human-level cognition. This type of technology is still highly experimental, and most experts agree it has not yet been achieved. Super AI refers to technology that surpasses human cognition and intelligence. This is the kind of AI you might see depicted in movies, like Skynet from the Terminator movies.

Automation

Automation, like artificial intelligence, is a very broad term. It refers to any task that can be set to perform automatically without a human operating it. Usually the task must be set up within a program where the parameters are specified, and after that the task will occur automatically when the specified action triggers it. A marketing automation platform, for example, allows you to send a welcome email automatically every time a new customer is added to the system. While not all automation requires AI, AI is often employed in order to automate tasks intelligently.

While not all automation requires AI, AI is often employed in order to automate tasks intelligently.

Machine Learning (ML)

Machine Learning (ML) is a type of AI that “learns” (or adapts its behavior) as it acquires data—for example the algorithms that suggest recommendations to you in Amazon, Spotify, or Netflix based on previous purchases or choices you’ve made. This is done through statistical inference and predictive modeling—the software infers a likely output given a set of input data. The more data the technology acquires, the more accurate its predictions will be, hence the “learning” aspect.

Natural Language Processing (NLP)

Natural Language Processing (NLP) is a branch of AI that helps humans interact with computers using natural language like speech or text—for example, your phone’s ability to compose a text that you dictate, or Siri’s ability to respond to speech commands. Another common application of this technology is the use of chatbots, which are programs that can respond to written chat queries using a set of predetermined responses. Read our blog on chatbots to learn more.

Robotics Process Automation (RPA)

Robotics Process Automation (RPA) uses software bots to perform a selected series of actions on a computer. It’s often used to eliminate manual data entry or transfer, allowing data to be read from one system and entered into another. It can also be used to compile data across systems, generate reports, or complete routine processes like creating or cancelling accounts.

Internet of Things (IoT)

The Internet of Things (IoT) refers to smart devices (other than computers and smartphones) that collect and interpret data. This could include virtual assistants like Google Home and Amazon Echo, wearable fitness technology, smart appliances, home security and surveillance devices, and more. Within the realm of insurance, IoT can help provide real data on customer activity such as driving, health, and home security habits that could impact their policy coverage or premiums.

Applications in Insurance

Now that we’ve defined what AI is and how it can be used in the business world, what are its specific applications in the insurance industry? AI can offer many benefits to agents, carriers, and other participants in the insurance value chain.

Benefits of AI solutions

Saves time and money

AI can often handle routine, manual processes more quickly than a person, saving operational costs and freeing up staff to focus on more impactful work with clients.

Provides 24/7 service

AI tools like chatbots can provide 24/7 service to customers, allowing them to receive help outside office hours.

Improves customer experience

AI automates processes, leading to faster results for the customer. It can also aid in creating a more personalized product and experience for the customer.

Increasing accuracy

Machine learning becomes more accurate as more data is acquired, so the results will become better and better as time goes on.

Provides documentation

AI tools keep automatic records of everything they do, creating a documented history to produce reports from or refer to for E&O purposes.

Need some examples? Here are some of the top ways AI is already being implemented within the insurance industry.

Underwriting

AI can provide additional insight into the underwriting process, extracting relevant data from customers’ social media, reviews, and other online activity to build more personalized policies for consumers based on their individual lifestyle. This can aid in determining the risk factor for a client, and machine learning can compare across vast data sets to more accurately estimate exposure and even use predictive analytics to predict future risk factors or need for policy changes (Agency Nation).

AI can provide additional insight into the underwriting process, extracting relevant data from customers’ social media, reviews, and other online activity to build more personalized policies for consumers based on their individual lifestyle. This can aid in determining the risk factor for a client, and machine learning can compare across vast data sets to more accurately estimate exposure and even use predictive analytics to predict future risk factors or need for policy changes (Agency Nation).

IoT technology has also begun to transform the underwriting process, allowing clients to pay for only the coverage they need based on their actual tracked behaviors. Devices like the Progressive Snapshot, which provides data on how the client drives and offers lower auto premiums for better driving behavior, have been around for some time, but this type of technology is now expanding to other areas as well. See some great examples here, including smart smoke alarms that reduce fire risk and home premiums, wearable fitness devices that affect life insurance coverage and cost, smart doorbells connected to home policies, and even smart toothbrushes tied to dental insurance policies.

IoT technology has begun to transform the underwriting process, allowing clients to pay for only the coverage they need based on their actual tracked behaviors, from driving to home security to wellness habits.

Data entry and routine processes

Manual data entry is a tedious and time-consuming part of many insurance processes on both the agency and carrier side. AI applications like RPA can greatly reduce the resources needed for this, completing data entry tasks in 40% of the time and with half the workforce (AIthority). In an industry where data is often siloed in incompatible systems, RPA can seamlessly read data from one system and write it into another.

Routine tasks, like policy creation or cancellation, can be automated with AI as well. On an episode of the Connected Insurance podcast, Chisel AI founder and CEO Ron Glozman describes how his program, initially created to read textbooks, has been customized to read insurance policies and binders. Data points can even be extracted from application submissions to automatically initiate the process with the carrier without human intervention.

Claims

Claims continue to be one of the most manual and labor-intensive processes in the insurance industry, and historically one that significantly impacts customer satisfaction. AI is being employed to combat this in a number of ways:

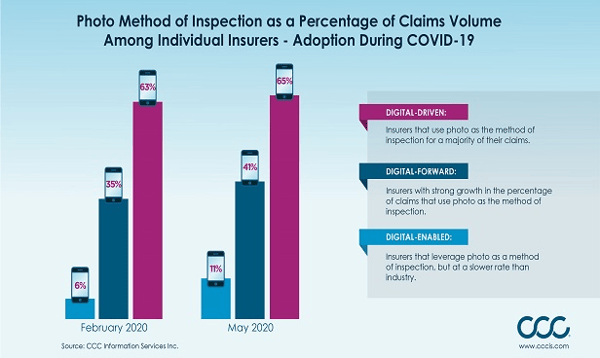

- Digital image processing to assist damage estimation by comparing against images of similar damage on similar vehicles, read license plate numbers, and flag photos that have been previously submitted as fraudulent (PropertyCasualty360).

- Faster processing by identifying incoming correspondence, indexing metadata, and routing claim files to the appropriate queue for review to provide quick access to adjudicators (Insurance Journal).

- Error tracking, claim verification, and compilation of claims data from multiple systems and sources (The Lab Consulting).

- Self-scheduling for claims appointments and repair work (IA Magazine).

- Automated disbursements to policyholders and vendors (Agency Nation).

Image source: PropertyCasualty360, courtesy of CCC Information Services Inc.

Image source: PropertyCasualty360, courtesy of CCC Information Services Inc.

24/7 customer service

One of the hottest topics for independent agents around AI right now is chatbots, which use a chat window on a business’s website to answer questions submitted via chat in real time with a set of predetermined responses and actions. Chatbots can greatly reduce the amount of time staff spend answering routine questions, and allow customers to get help 24/7, even when staff isn’t in the office. They’ve been shown to cut operational costs by 30%, and 64% of internet users identified 24-hour service as their best feature (ACT).

Chatbots have been shown to cut operational costs by 30%, and 64% of users identified 24-hour service as their best feature.

Chatbots can be a double-edged sword, however. While a survey by Globant found that 34% of policyholders want to switch to a chatbot if they’ve been on hold with a live agent for five minutes, over 50% also grow frustrated if a chatbot has yet to provide them a clear path to resolution within five minutes (IA Magazine). Policyholders are most open to using chatbots for more routine activities such as policy reminders (36%) or checking the status of a claim (29%), with more complex issues being escalated to a staff member to resolve. Take a look at ACT’s Resource Guide to Chatbots for more information on whether chatbots could be a valuable tool for your agency.

Lead acquisition & customer retention

AI’s ability to extract meaningful data from social media and other online behaviors or interactions makes for more accurate lead scoring, helping agencies to identify their hottest leads and find high-value groups to target.

This can be helpful in customer retention as well. AI-powered analytics systems can give greater insight into customer activities, arming agencies to create more impactful cross-selling and renewal opportunities. Some programs can also predict customer “sentiment,” or how they feel about the agency or their policy, and flag customers you may be at risk of losing. Check out this guest post by Aureus Analytics, an analytics and machine learning platform that integrates with HawkSoft, to learn more about how AI tools can help you use data to grow your agency.

Myths about AI

The insurance industry often lags behind the technology curve, creating a fear of adopting new technologies. We want to address some of the common misconceptions about AI to empower agents to adopt AI tools in ways that will be impactful for their agencies.

Myth: AI is too technical for me to understand or use

While the back-end of artificial intelligence can indeed be technically complicated, the user interfaces of these tools are generally designed to be user-friendly. In fact, your agency may already be using AI-powered tools without realizing it. If you use programs that employ lead scoring, advanced analytics, web chat tools, or smart forms that show different content depending on responses, chances are they’re powered by some level of AI.

Myth: AI will replace people or jobs

Don’t worry—robots aren’t about to take our jobs. Narrow AI (which all the applications here fall under) can only perform specific tasks under specified parameters; it can’t perform tasks that require human cognition or judgment. AI tools are famously said to “take the robot out of the person,” meaning they take on the repetitive tasks that require little thought so employees can focus on the areas that require more skill and creativity. Take it from Sean Kennedy at Globant: “It’s all about augmenting the people, not replacing the people. [AI] is really there to help make the human employees more effective—to help them focus on the more important aspects of customer service.”

“It’s all about augmenting the people, not replacing the people. [AI] is really there to help make the human employees more effective—to help them focus on the more important aspects of customer service.”

Sean Kennedy, Globant

Myth: I won’t know or have control over what an AI process is doing

Most AI tools are built to be customized, giving you complete control over what actions it completes and what triggers those actions. These programs usually require a certain level of human oversight—often you can set them to flag more complicated cases for human review, ensuring you have the final say on what action is completed.

Myth: AI is a perfect and infallible solution

On the flip side, people may assume that because it’s run by advanced technology, AI can never be “wrong.” In AI, as with many technologies, the output will only be as good as the input—meaning that if the data or parameters you set are off, the end result will be too. AI tools shouldn’t be thought of as “set it and forget it”—they should be regularly checked to ensure they’re working the way you want them to, and tweaked as you see what works well and what doesn’t.

AI solutions might not be the right fit for everyone. Tools can be expensive to purchase or to customize to work with your processes, possibly outweighing the benefit they would provide. Some tools also need large amounts of data to analyze in order to function as desired, and it can be difficult to take unstructured data (not in a standard format) and structure it in a way that’s useful. Be sure to weigh the costs and difficulties against the benefits before deciding whether to implement AI tools at your agency.

Work smarter, not harder

The potential of AI is limitless, not only within the insurance industry but in the world at large. AI tools can help agencies complete the routine, process-oriented elements of their work more efficiently, leaving them more time to do the important work of growing their business. By embracing the power of AI, agencies can work smarter, not harder, to win the loyalty of the modern consumer.

Learn more about Aureus Analytics and other HawkSoft integration partners that utilize AI |